Kenya’s capital Nairobi, September 23, 2011. The road, which is being built by China Wuyi, Sinohydro and Shengeli Engineering Construction group, is funded by the Kenyan and Chinese government and the African Development Bank (AFDB). REUTERS/Thomas Mukoya

The citizens of the African continent have been introduced to one grand vision of development after the other – from OAU to AU. However, there is a tendency by some of the member countries to retreat from fulfilling regional treaty commitments, which, in some cases, would entail losing a degree of sovereignty.

What is the biggest stumbling block to achieving the African Integration Vision?

But after more than 50 years of solemn regional integration declarations these rhetorical and symbolic efforts still haven’t made the regional integration schemes any more inclusive. For example, when analysing the ‘inclusiveness’ trends as measured by Poverty and Income Distribution Indicators, most Sub-Saharan African countries won’t achieve the MDG target of reducing extreme poverty rates by half ahead of the 2015 deadline. This is despite the increasing total merchandise export as well as within most of the regional economic communities (RECs).

Some have tried to absolve policy-makers of the lack of progress with regards to achieving the milestones of the “linear” integration model based on the European experience and advocated by the Abuja Treaty. They propose an alternative non-trade oriented approach; the so-called functional regional cooperation. This perspective focuses on setting standards for transport such as the SADC recognized driving license; construction of a new regional corridors; an African identity etc. This less ambitious but perhaps more realistic perspective could lead to failure in removal of trade barriers, while at the same time presenting a much more positive outlook of regional integration than what international economic data would otherwise show.

The AfDB is attempting to get to the bottom of this regional integration – inclusive growth conundrum in its 2013 African Development Report, currently under preparation. But we might already get some good answers to this question through an ongoing research project entitled ‘PERISA‘. Led by the ECDPM & SAIIA, it intends to look deeper into what regional integration/cooperation really entails and what the underlying drivers/factors and specific bottlenecks are. In July, we got a hint on what to expect from the research project from a very enriching Dialogue on the Drivers and Politics of Regional Integration in Southern Africa.

National versus Regional

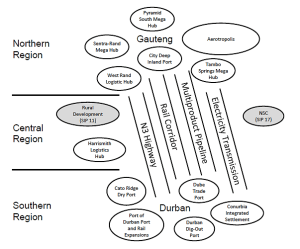

South Africa has developed a ‘2030 vision’ and national strategic plan. It includes some proposals to reposition South Africa hegemon in the region. However, very few of the National Development Plans (NDP) in Southern Africa even mention regional integration. Mauritius being an exception as it benefits from the support of the Regional Integration Support Mechanism (RISM), which is disbursed directly into the budget of the government as untargeted financial assistance. Notwithstanding this support and the disbursement to the nine other Member States of the Common Market for Eastern and Southern Africa (COMESA) and additional donor-supported initiatives in other RECs, there is still a flagrant absence of alignment between commitments taken at the regional level and the actual planning process at the national level.

This discrepancy between the regional and national level is a matter of concern because if these Regional Trade Agreement (RTA) commitments do not feature amongst the country’s national priorities then there is an even greater risk that they will not be implemented in practice. This latent risk perhaps goes a long way in explaining the relative poor record when it comes to the level of domestication of regional integration legal instruments, implementation of trade and regionalintegration-related budgets, implementation of Council of Ministers’ trade-related decisions, which the AfDB will seek to capture through its forthcoming system to measure regional integration in Africa.

During the meeting a call for a community of practice among national planning agencies was made which could assist and drive the integration process through the convening of regular meetings between regional and strategic national planners. It is positive to observe that Southern African countries seem to have warmed up to this idea of an informal community of practice outside the formal institutional structure.

What can Development Finance Institutions do about this inertia?

In addition to the supply-driven collection of regional integration statistics, Multilateral Development Banks (MDBs) could also lend technical and financial support to the formation of Regional Planning entities’ process. Amongst others this could include providing support to the above-mentioned community of practice of national development planners interacting with regional planners. This could eventually ensure that regional integration gets fully mainstreamed within the national planning policy instruments as illustrated in Mauritius’ latest 2013 budget, whose overarching theme rests on six main objectives, including fast-tracking regional integration.

There seems to be a consensus that the RECs must have technical capacity to facilitate the RTA negotiation process and decision-making process. Both the UK Department for International Development (DFID) through its TMSA programme and the AfDB through its forthcoming 2014-2016 Tripartite Capacity Building Programme are attempting to address this deficiency in a coordinated manner in line with fundamental principles of the Paris Declaration on Aid Effectiveness. Source: ECDPM

website (An analysis by Christian Kingombe, Chief Regional Integration & Infrastructure Officer at the AfDB).

Related articles

- SA Trade Policy Goes Against Integration Tide (mpoverello.com)

You must be logged in to post a comment.