African countries are coming under strong pressure from the United States and the European Union to reverse the decision adopted by their trade ministers to implement the World Trade Organization’s trade facilitation agreement on a “provisional” basis.

African countries are coming under strong pressure from the United States and the European Union to reverse the decision adopted by their trade ministers to implement the World Trade Organization’s trade facilitation agreement on a “provisional” basis.

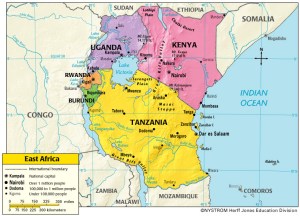

At last week’s summit of African Union leaders in Malabo, Equatorial Guinea, “there was unprecedented [U.S. and European Union] pressure and bulldozing to change the decision reached by the African trade ministers on April 27 in Addis Ababa, Ethiopia, to implement the trade facilitation (TF) agreement on a provisional basis under paragraph 47 of the Doha Declaration,” Ambassador Nelson Ndirangu, director for economics and external trade in the Kenyan Foreign Ministry, told IPS.

“This pressure comes only when the issues and interests of rich countries are involved but not when the concerns of the poorest countries are to be addressed,” Ambassador Ndirangu said.

“Clearly, there are double-standards,” the senior Kenyan trade official added, lamenting the pressure and arm-twisting that was applied on African countries for definitive implementation of the agreement.

The TF agreement was concluded at the WTO’s ninth ministerial conference in Bali, Indonesia, last year. It was taken out of the Doha Development Agenda as a low-hanging fruit ready for consummation. More importantly, the agreement was a payment to the United States and the European Union to return to the Doha negotiating table.

The ambitious TF agreement is aimed at harmonising customs rules and regulations as followed in the industrialised countries. It ensures unimpeded market access for companies such as Apple, General Electric, Caterpillar, Pfizer, Samsung, Sony, Ericsson, Nokia, Hyundai, Toyota and Lenovo in developing and poor countries.

Former WTO Director-General Pascal Lamy has suggested that the TF agreement would reduce tariffs by 10 percent in the poorest countries.

In return for the agreement, developing and least-developed countries were promised several best endeavour outcomes in the Bali package on agriculture and development.

They include general services (such as land rehabilitation, soil conservation and resource management, drought management and flood control), public stockholding for food security, an understanding on tariff rate quota administration, export subsidies, and phasing out of trade-distorting cotton subsidies (provided largely by the United States) in agriculture.

The non-binding developmental outcomes include preferential rules of origin for the export of industrial goods by the poorest countries, a special waiver to help services suppliers in the poorest countries, duty-free and quota-free market access for least developed countries (LDCs), and a monitoring mechanism for special and differential treatment flexibilities.

African countries were unhappy with the Bali package because they said it lacked balance and was tilted heavily in favour of the TF agreement forced by the industrialised countries on the poor nations.

The Bali outcomes, said African Union Trade Commissioner Fatima Acyl, “were not the most optimal decisions in terms of African interests … We have to reflect and learn from the lessons of Bali on how we can ensure that our interests and priorities are adequately addressed in the post-Bali negotiations.”

The African ministers in Malabo directed their negotiators to propose language on the Protocol of Amendment – the legal instrument that will bring the TF agreement into force at the WTO – that the TF agreement will be provisionally implemented and in completion of the entire Doha Round of negotiation.

African countries justify their proposal on the basis of paragraph 47 of the Doha Declaration which enables WTO members to implement agreement either on a provisional or definitive basis.

The African position on the TF agreement was not acceptable to the rich countries. In a furious response, the industrialised countries adopted a belligerent approach involving threats to terminate preferential access.

The United States, for example, threatened African countries that it would terminate the preferential access provided under the Africa Growth Opportunities Act (AGOA) programme if they did not reverse their decision on the TF, said a senior African trade official from Southern Africa.

The WTO has also joined the wave of protests launched by the industrialised countries against the African decision for deciding to implement the TF on a provisional basis. “I am aware that there are concerns about actions on the part of some delegations [African countries] which could compromise what was negotiated in Bali last December,” WTO Director-General Roberto Azevedo said, at a meeting of the informal trade negotiations committee on June 25.

The African decision, according to Azevedo, “would not only compromise the Trade Facilitation Agreement – including the technical assistance element. All of the Bali decisions – every single one of them – would be compromised,” he said.

The United States agreed with Azevedo’s assessment of the potential danger of unravelling the TF agreement, and the European Union’s trade envoy to the WTO, Ambassador Angelos Pangratis, said that “the credibility of the negotiating function of this organisation is once again at stake” because of the African decision.

The United States and the European Union stepped up their pressure by sending security officials to Malabo to oversee the debate, said another African official. He called it an “unprecedented power game rarely witnessed at an African heads of nations meeting.”

In the face of the strong-arm tactics, several African countries such as Nigeria and Mauritius refused to join the ministerial consensus to implement the TF agreement on a provisional basis. Several other African countries subsequently retracted their support for the declaration agreed to in April.

In a nutshell, African Union leaders were forced to change their course by adopting a new decision which “reaffirms commitment to the Doha Development Agenda and to its rapid completion in accordance with its development objectives.”

The African Union “also reaffirms its commitment to all the decisions the Ministers took in Bali which are an important stepping stone towards the conclusion of the Doha Round … To this end, leaders acknowledge that the Trade Facilitation Agreement is an integral part of the process.”

Regarding capacity-building assistance to developing countries to help them implement the binding TF commitments, African Union countries still want to see up-front delivery of assistance. The new decision states that African Union leaders “reiterate in this regard that assistance and support for capacity-building should be provided as envisaged in the Trade Facilitation Agreement in a predictable manner so as to enable African economies to acquire the necessary capacity for the implementation of the agreement.”

The decision taken by the African leaders is clearly aimed at implementing the TF decision, but there is no clarity yet on how to implement the decision, said Ndirangu. “We never said we will not implement the TF agreement but we don’t know how to implement this agreement,” he added.

In an attempt to ensure that the rich countries do not walk away with their prized jewel in the Doha crown by not addressing the remaining developmental issues, several countries – South Africa, India, Uganda, Tanzania, Solomon Islands and Zimbabwe – demanded Wednesday that there has to be a clear linkage between the implementation of the TF agreement and the rest of the Doha Development Agenda on the basis of the Single Undertaking, which stipulates that nothing is agreed until everything is agreed!

More than 180 days after the Bali meeting, there is no measurable progress on the issues raised by the poor countries. But the TF agreement is on course for final implementation by the end of 2015. Source: Inter Press Service

![Presidents Uhuru Kenyatta (Kenya), Paul Kagame (Rwanda) and Yoweri Museveni after the trilateral talks in Entebbe, Uganda. President Jakaya Kikwete of Tanzania and Pierre Nkurunziza of Burundi stayed out of the loop of the third infrastructure summit in Kigali, Rwanda on Monday. [Photo/PPS]](https://mpoverello.com/wp-content/uploads/2014/02/eac-sct-postponed.jpg?w=580)

You must be logged in to post a comment.