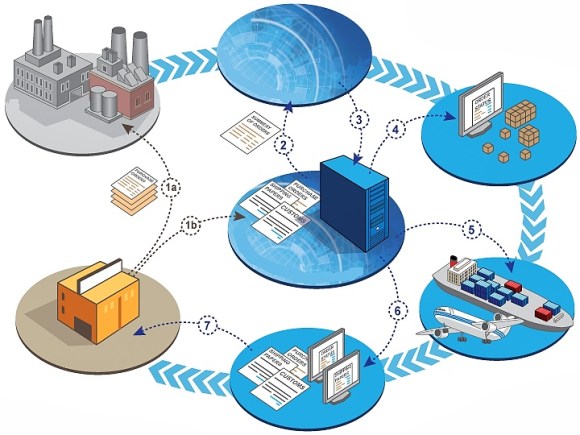

The British government has started to conduct research on its new post-Brexit customs IT system, with four months left before the service is due to go live.

Her Majesty’s Revenue & Customs, which is in charge of handling the new customs paperwork that will apply to UK-EU trade from 2021, has invited hauliers to participate in rounds of remote-user testing in the coming months for its Goods Vehicle Movement Service (GVMS), according to a memo to the freight forwarding industry.

The GVMS – which is set to be used to police cross-Irish Sea trade from Jan 1 2021, and then all UK-EU goods flows from July – will give freight companies a unique reference number that proves that they have filed the necessary post-Brexit paperwork, such as customs declarations.

Without a reference from the GVMS, trucks will not be allowed to cross between the UK and EU.

The fact that the GVMS is still in the research and design phase less than 90 working days before it is due to be introduced is a cause for concern in the logistics industry: one freight forwarder, who spoke under condition of anonymity, said they are worried the service won’t be completed and functional on time.

The new system will be required even if Britain and the EU sign a free-trade agreement.

And while consultation with the industry is welcome, it would have been preferable to do such research during the system design process, said Anna Jerzewska, founder of Trade and Borders, a customs and trade consultancy.

“The Government has made it clear that GVMS is unlikely to be ready for January 1 and as far as we understand there will be back-up procedures in place,” she said.

“It will be crucial to ensure that such alternatives are available in places where traffic management will be important,” she said, citing Kent and the Irish Sea.

In the memo, HMRC says it wants to start the first round of testing “ASAP” due to the shortage of time.

The tests will involve hour-long video calls where hauliers try prototypes and give feedback.

“When designing a system that the industry will be using, it is important we work in partnership with them to make sure it suits their and our needs,” HMRC said by email.

“We will continue to develop our systems in readiness for the end of the transition period and when full border controls are implemented from July 2021.”

Source: Bloomberg, article authored by Joe Mayes, 28 August 2020

A new book by Dr. Rolf Neise examines how the global shipping container industry has witnessed an unprecedented shift as a result of a dynamic change in the global container trade landscape. Whilst the maritime container business has been studied in-depth, the impact on shippers and how shippers deal with the given challenges has not been fully examined until now.

A new book by Dr. Rolf Neise examines how the global shipping container industry has witnessed an unprecedented shift as a result of a dynamic change in the global container trade landscape. Whilst the maritime container business has been studied in-depth, the impact on shippers and how shippers deal with the given challenges has not been fully examined until now.

You must be logged in to post a comment.