The following is a blog article by Taku Fundira, published via Tralac dated 28 March 2023.

The African Continental Free Trade Area (AfCFTA) which is set to be the largest free trade area (FTA) in the world with 54 of the 55 members of the Africa Union being signatories to the Agreement. The AfCFTA if fully implemented, is expected to provide a major opportunity for African countries to attract Foreign Direct Investment (FDI), diversify exports, boost intra-African trade, boost growth, reduce poverty, foster economic inclusion, and promote sustainable economic development.

Currently, countries are not trading under the AfCFTA trading regime, however, Phases I and Phase II negotiations have been completed albeit tariff concessions and rules of origin (RoO) negotiations for some products are still underway. These two issues, partly attribute to the reasons why it is not yet possible to trade under the AfCFTA. Phase III negotiations are currently underway and include protocols on additional topics such e-commerce. Trade and Women and Youth in Trade Protocol which was added to the AfCFTA agenda has since been concluded is expected to be approved later in 2023.

The Guided Trade Initiative

Despite countries, not yet trading fully under the AfCFTA, a pilot initiative called; the Guided Trade Initiative (GTI) which aims to stress test trading in goods between member countries within the operational, institutional, legal and trade policy environment under the AfCFTA was launched in Accra on 7th October 2022. Eight countries are participating in this pilot. Tanzania following Rwanda, Kenya, and Ghana, have begun trading under the GTI. The AfCFTA GTI has identified 96 products, including tea, coffee, processed meat products, sugar, and dried fruits, to be traded among the participating countries. Tanzania aims to sell 10 products under the AfCFTA’s GTI including coffee and glassware. Plans are underway to have a similar GTI for services subject to State Parties agreeing on modalities.

Initial assessment of the GTI reveals that there remain significant challenges for African countries to trade smoothly and boost intra-African trade mainly because non-tariff barriers (NTBs) to trade remain prevalent, massive infrastructure gaps especially transport infrastructure pose a threat to the success of not only the GTI but also to the AfCFTA. For Africa to make the most of free trade, the continent must address these challenges. Estimates suggest most African landlocked countries face high transport prices which are three to four times more than in most developed countries. Several institutional, political and other factors that combine to limit competition, encourage corruption, discourage investment and encourage informal activity attribute to the prevalent high prices in Africa.

Non-tariff trade costs extremely high

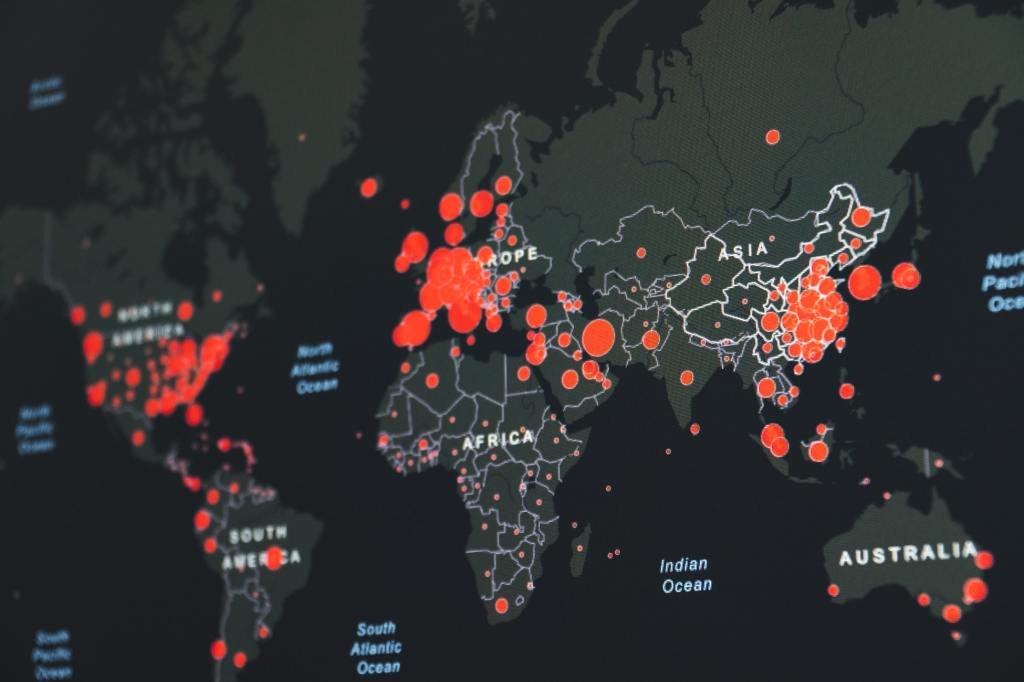

Latest available data from the World Bank on non-tariff trade costs (NTTCs) reveal that on average goods traded between African states accrue 292% ad valorem equivalent (AVE) in NTTCs. Non-tariff trade costs include among others, transport costs; direct and indirect costs associated with differences in languages and currencies, cumbersome import, and export procedures. Despite commitments by regional economic communities (RECs) to reduce NTTCs through mechanisms such as the NTB online monitoring mechanism under the Tripartite FTA and under the AfCFTA demonstrate the importance of ensuring that NTBs do not impede intra-Africa trade, reducing NTTCs.

Tralac has produced an infographic on intra-Africa NTTCs using the ESCAP – World Bank Trade Cost Database which can be found on the tralac website and it reveals the following:

- Over a 10-year period (2011 – 2020) there have been no significant changes in non-tariff trade costs (NTTC). NTTCs decline by 2% CAGR (compound annual growth rate) over the review period (2011-2020).

- Agricultural products’ NTTC remain much higher than manufacturing products’ NTTCs over the review period (2011-2020), although declining relatively much faster over the last 5 years relative to manufacturing products’ NTTCs. Between 2016 and 2020, agricultural and manufacturing NTTCs declined by 2.5% (CAGR) and 1.4% (CAGR) respectively.

- The average intra-Africa NTTC on agriculture and manufacturing in 2020 (latest available data) is 330% (AVE) and 253% (AVE).

- Intra-REC NTTCs are lower than between RECs (inter-REC)

- COMESA has the highest average intra-REC NTTCs (285% AVE) and EAC has the lowest (135% AVE)

- ECOWAS has the highest average inter-REC NTTCs (347% AVE) and EAC has the lowest (269% AVE)

- ECOWAS – EAC inter-REC average NTTCs are the highest at 416% (AVE) followed by ECOWAS – COMESA at 389% (AVE)

- SADC and COMESA’s inter-REC average non-tariff trade costs are more or less the same at 300% (AVE) and 306% (AVE) respectively

Based on these findings it is not surprising why intra-Africa trade has remained low averaging 18% of Africa’s global trade over the past decade. Intra-Africa trade remains regional and limited to neighbouring countries partly due to these NTTCs which if left unchecked will hamper the goals of the AfCFTA. Therefore, their reduction can be a gamechanger for the AfCFTA and more specifically for African economic development.

Trade facilitation key to reducing NTTCs

The extent to which the AfCFTA will be effective to reduce trade costs depends importantly on governments addressing NTBs, including in services markets. Trade facilitation becomes key to the success of reducing NTTCs, by improving trade and customs procedures as well as facilitating the relationship between businesses and government agencies at the border to reduce costs, while protecting the intended regulatory objectives. Estimates from the UNECA (United Nations Economic for Africa) project that intra-Africa trade could double through enhanced trade facilitation and the reduction of NTBs in the AfCFTA.

The AfCFTA Agreement provides a legal framework with specific undertakings for trade facilitation and the elimination of barriers contained in Annex 3 on Customs Co-operation and Mutual Administrative Assistance; Annex 4 on Trade Facilitation; and Annex 8 on Transit. Annex 3 deals with trade facilitation in customs administration. Within RECs efforts to reduce NTBs have yielded significant progress (e.g., Tripartite FTA NTBs monitoring mechanism), however more needs to be done on trade facilitation as little progress has been made here.

What needs to be done?

A limited number of Strategic Corridors has been identified considering their potentialities to facilitate sustainable, efficient, smart, resilient, fair, affordable, secure, and safe mobility and trade within Africa.

State parties should be serious about implementing their trade facilitation obligations or fulfilling their duties under the AfCFTA Agreement and therefore legally binding and justiciable mechanisms should be put in place to ensure transparency, certainty and predictability. These must be complemented by regional and national instruments and measures. In effect Member States should implement their binding obligations. State parties’ customs authorities/agencies should be capacitated and coordinated. This would go a long way in improving trade facilitation governance in Africa and leveraging AfCFTA benefits.

Financing the AfCFTA and associated trade facilitation measures will go a long way in ensuring the success of regional integration in Africa. Furthermore, transport infrastructure should be prioritised. It is important to note that projects are already in progress to boost the development of continent-wide infrastructure. For example, Tanzania’s construction of the Standard Gauge Railway Project is expected to provide a safe and reliable means for efficiently transporting people and cargo to and from the existing Dar-es-Salaam port. Other large projects underway include the Trans-Maghreb Highway in North Africa, North-South Multimodal Corridor, the Central Corridor project, and the Abidjan-Lagos Corridor Highway project.

In conclusion, reducing the NTTCs will be a gamechanger for the AfCFTA. What’s needed is for Member States to rise to the occasion by concluding the outstanding negotiations, especially resolving teething issues with respect to specific products especially outstanding RoO issues and finalising tariff concessions. Furthermore, the political, social, and economic environment should be managed both at the regional and national levels with the ultimate goal of ensuring the success of the AfCFTA.

Read the Full Article, with annotations here!

Source: Tralac

Zimbabwe’s Deputy Finance and Economic Planning Minister Terrence Mukupe has estimated that the country has lost an estimated $20 million in revenue receipts since ZIMRA’s automated Customs processing system (ASYCUDA World) collapsed in the wake of server failure on 18 December 2017.

Zimbabwe’s Deputy Finance and Economic Planning Minister Terrence Mukupe has estimated that the country has lost an estimated $20 million in revenue receipts since ZIMRA’s automated Customs processing system (ASYCUDA World) collapsed in the wake of server failure on 18 December 2017.

The implementation of the Government’s new pre-shipment regulations under the Consignment Based Conformity Assessment (CBCA) programme (essentially a fancy term for plain old pre-shipment inspection – who they trying to fool?) took off with host of challenges last Tuesday. The new regulations that were gazetted into law on 18 December last year and requires that goods be tested for conformity with required standards prior importation into Zimbabwe, went into operation on 1 March.

The implementation of the Government’s new pre-shipment regulations under the Consignment Based Conformity Assessment (CBCA) programme (essentially a fancy term for plain old pre-shipment inspection – who they trying to fool?) took off with host of challenges last Tuesday. The new regulations that were gazetted into law on 18 December last year and requires that goods be tested for conformity with required standards prior importation into Zimbabwe, went into operation on 1 March. The following article is published with the kind permission of the author, Tapia Naula who is Principal Transport Economist at African Development Bank, based in the Ivory Coast. He is an international project manager and transport economist with experience in logistics business, research and trade facilitation. This article is a must for anyone associated with or working on the TFA on the African sub-continent, and a bit of a wake up call to those countries who have as yet done little or nothing to progress their participation.

The following article is published with the kind permission of the author, Tapia Naula who is Principal Transport Economist at African Development Bank, based in the Ivory Coast. He is an international project manager and transport economist with experience in logistics business, research and trade facilitation. This article is a must for anyone associated with or working on the TFA on the African sub-continent, and a bit of a wake up call to those countries who have as yet done little or nothing to progress their participation.

Zimbabwe has introduced custom-control measures aimed at reducing the inflow of smuggled and inferior goods, and boosting its revenue from customs duty. Goods being exported to Zimbabwe will have to undergo consignment verification from May 16.

Zimbabwe has introduced custom-control measures aimed at reducing the inflow of smuggled and inferior goods, and boosting its revenue from customs duty. Goods being exported to Zimbabwe will have to undergo consignment verification from May 16. The role of the private sector in the implementation of the World Trade Organization’s (WTO) Trade Facilitation Agreement (TFA) will be the focus of the 2015 edition of the Global Facilitation Partnership for Transportation and Trade (GFP) meeting. With the world’s customs administrations currently identifying their respective TFA implementation commitments and setting up National Trade Facilitation Committees, trade and logistics operators can learn how they can participate in such initiatives by attending these sessions.

The role of the private sector in the implementation of the World Trade Organization’s (WTO) Trade Facilitation Agreement (TFA) will be the focus of the 2015 edition of the Global Facilitation Partnership for Transportation and Trade (GFP) meeting. With the world’s customs administrations currently identifying their respective TFA implementation commitments and setting up National Trade Facilitation Committees, trade and logistics operators can learn how they can participate in such initiatives by attending these sessions.

You must be logged in to post a comment.