The Japanese-funded e-Customs system known as “VNACCS/VCIS” (Vietnam Automated Cargo and Port Consolidated System and the Vietnam Customs Information System) is set to “go live” on April 1, 2014.

The Japanese-funded e-Customs system known as “VNACCS/VCIS” (Vietnam Automated Cargo and Port Consolidated System and the Vietnam Customs Information System) is set to “go live” on April 1, 2014.

Based on the NACCS/CIS of Japan, VNACCS/VCIS is intended to handle e-Declaration, e-Manifest, e-Invoice, e-Payment, e-C/O, selectivity, risk management/criteria, corporate management, goods clearance and release, supervision and inspection.

With the launch of the VNACCS/VCIS, Vietnam Customs is trying to simplify customs clearance procedures, reduce clearance time, enhance the management capacity of customs authorities in line with the standards of modern customs, as well as to cut costs and facilitate trade. VNACCS/VCIS also purports to ensure Vietnam’s compliance with the ASEAN “single window” initiative.

VNACCS/VCIS is intended to improve on the current e-Customs system. For example, the VNACCS/VCIS provides new procedures for the management of pre-clearance, clearance and post-clearance processes, adds new customs procedures such as registration of the duty exemption list, introduces a combined procedure for both commercial and non-commercial goods, simplifies procedures for low unit value goods and offers new management procedures for temporarily exported/imported goods, etc.

After the testing phase (which took place from November 2013 until the end of February 2014), users have been raising concerns regarding the VNACCS/VCIS system’s complexity. VNACCS/VCIS provides a declaration process with 109 export and 133 import data fields, compared to the current 27 export and 38 import declaration fields. Many of them are not compatible with the actual systems of companies, and appear to require from declarers an extensive knowledge of customs-related matters.

Comment – from an outsider’s perspective, besides systems testing, it would seem to appear that insufficient time has been allocated for alignment of industry systems to Vietnam Customs’ new data requirements. This, and the fact that no ‘grace period’ (waiver of sanctions or penalties) will be considered by the customs administration does not bode well for a smooth transition.

VNACCS/VCIS employs the quantity reporting mechanism in the official Units of Measures (“UOMs”), often used in international trade statistics, yet creates significant obstacles to companies that do not have compatible manufacturing, inventory planning and control systems. Vietnam Customs has stated that it will work on improving this issue.

VNACCS/VCIS also applies the declaration of customs values at the unit level. Since unit costs and unit prices used in financial systems of companies may not always be identical to declared values, companies may fail to comply with such requirement. Sanctions may be applied from day 1 of the new systems activation.

Technical difficulties are also a matter of great concerns to business community, e.g. with asset tracking. Currently under VNACCS/VCIS, reporting is limited to 7 digits, incompatible with many companies having asset tracking systems with identification numbers of up to 20 digits. To address concerns raised by the business community about the new system, Japanese experts have agreed to support Vietnam Customs 1 year after the official implementation date of the system.

There are concerns for potential risks of non-compliance for wrong declaration due to lack of an adequate understanding of VNACCS/VCIS. Vietnam Customs has rejected a proposal for “grace period” before applying sanctions upon violations, but encourages companies to actively participate in training programs organized by customs authorities to better avoid potential non-compliance risks.

Another concern is the chance of system failure which may lead to severe interruptions and delays in clearance procedures. Vietnam Customs has ensured business community that they have a back-up contingency mechanism in place to support customs procedures in the event that VNACCS/VCIS fails to operate properly. In the meantime, a new circular detailing the implementation of VNACCS/VCIS is being drafted and should come into effect by the launch date. Various business associations are still trying to find ways to mitigate the likely disruption from the sudden transition to the new system. Source: Baker & McKenzie (Vietnam)

The Maputo Corridor Logistics Initiative (

The Maputo Corridor Logistics Initiative ( From time to time it is nice to reflect on a good news story within the local customs and logistics industry. Freight & Trade Weekly’s (2015.11.06, page 4) article – “SA will be base for development of single customs platform” provides such a basis for reflection. The article reports on the recent merger of freight industry IT service providers Compu-Clearing and Core Freight and their plans to establish a robust and agile IT solution for trade on the African sub-continent.

From time to time it is nice to reflect on a good news story within the local customs and logistics industry. Freight & Trade Weekly’s (2015.11.06, page 4) article – “SA will be base for development of single customs platform” provides such a basis for reflection. The article reports on the recent merger of freight industry IT service providers Compu-Clearing and Core Freight and their plans to establish a robust and agile IT solution for trade on the African sub-continent.

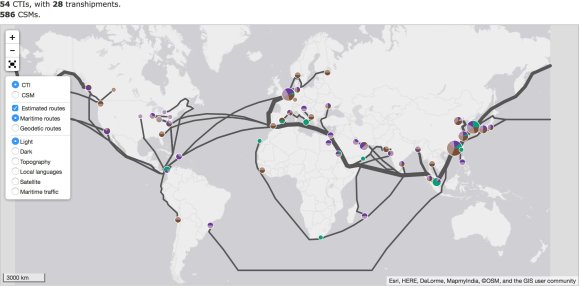

In collaboration with the European Anti-Fraud Office (OLAF), the JRC has worked extensively on how to exploit CSM data for customs anti-fraud purposes. The JRC proposed techniques, developed the necessary technology, and ran long-term experiments involving hundreds of EU customs officers to validate the usefulness of using CSM data. The results of this research led the Commission to bring forward a legislative proposal that would enable Member States and OLAF to systematically use CSM data for these anti-fraud purposes. It also served to convince Member States of the value of the proposed provisions.

In collaboration with the European Anti-Fraud Office (OLAF), the JRC has worked extensively on how to exploit CSM data for customs anti-fraud purposes. The JRC proposed techniques, developed the necessary technology, and ran long-term experiments involving hundreds of EU customs officers to validate the usefulness of using CSM data. The results of this research led the Commission to bring forward a legislative proposal that would enable Member States and OLAF to systematically use CSM data for these anti-fraud purposes. It also served to convince Member States of the value of the proposed provisions. The technologies, know-how and experience in handling CSM data, developed by the JRC through its experimental

The technologies, know-how and experience in handling CSM data, developed by the JRC through its experimental

You must be logged in to post a comment.