It’s quite amazing the number of reports featured in various african media across the continent pushing the ‘free trade’ agenda. The incumbent governments on the other hand are naturally concerned with dwindling tax collections, while at the same time increasing incidents of graft, collusion, and corruption run rampant at the border. While the following article states the obvious, unfortunately, nowhere will you find or read a practical approach which deals with increased ‘automation’ at borders and the consequential re-distribution of ‘bodies’ to other forms of gainful employment. Its jobs that will be on the line. Few governments wish to taunt their electorates – non-essential jobs are a fact of life and are destined to stay if that is what will earn votes and a further term in power. Moreover, there is no question of removing internal borders with the emphasis on costly ‘One-Stop Border’ facilities. To some extent the international donor community won’t mind this as there’s at least some profit and influence in it for them.

It’s quite amazing the number of reports featured in various african media across the continent pushing the ‘free trade’ agenda. The incumbent governments on the other hand are naturally concerned with dwindling tax collections, while at the same time increasing incidents of graft, collusion, and corruption run rampant at the border. While the following article states the obvious, unfortunately, nowhere will you find or read a practical approach which deals with increased ‘automation’ at borders and the consequential re-distribution of ‘bodies’ to other forms of gainful employment. Its jobs that will be on the line. Few governments wish to taunt their electorates – non-essential jobs are a fact of life and are destined to stay if that is what will earn votes and a further term in power. Moreover, there is no question of removing internal borders with the emphasis on costly ‘One-Stop Border’ facilities. To some extent the international donor community won’t mind this as there’s at least some profit and influence in it for them.

Poverty in Sub- Saharan Africa is a man-made phenomenon driven by internal warped policies and international trade systems. The continent cannot purport to seek to grow while it blocks the movement of goods and services through tariff regimes at the same time Tariff and non-tariff barriers contribute to inefficient delivery systems, epileptic cross-border trading and thriving of illicit/contraband goods.

This ultimately harms the local and regional economy. Delays at ports of delivery, different working hours and systems of control across the continent, unnecessary police roadblocks and poor infrastructure condemn countries to prisons of inter-regional and intra-regional trade poverty.

According to the United Nations Economic Commission for Africa, removal of internal trade barriers would lead to US$25 billion per year of intra-regional exports in Africa, an increase by 15,4 percent by 2022. Making African border points crossings more trade efficient would increase intra-regional trade by 22 percent come 2020. Trade barriers in East Africa Community alone increase the cost of doing business by 20 percent to 40 percent.

Such barriers include the number of roadblocks within each country, cross- border charges for trucks and weighing of transit vehicles on several points on highways. Kenya is grappling to reduce the number of its roadblocks from 36 to five and Tanzania from 30 to 15. Sub-Saharan Africa records an average port delay of 12 days compared to seven days in Latin America and less than four days in Europe. Africa is lagging behind!

In West Africa, Ghanaian exports to Nigeria are faced with informal payments and delays as the goods transit across the country borders whether there is proper documentation. In the Great Lakes Region, an exporter is faced with 17 agencies at the border between Rwanda and Democratic Republic of Congo each with a separate monetary charge sheet.

A South African retail chain Shoprite reportedly pays up to US$20 000 a week on permits to sell products in Zambia. Each Shoprite truck is accompanied with 1 600 documents in order to get its export loads across a Southern African Development Community border. Tariff and non-tariff barriers simply thicken the wall that traps Africans in economic poverty.

The new African Union chair should push for urgent steps to lower barriers to trade within Africa. Border control agencies need retraining and border country governments need to integrate their processes; long truck queues waiting to cross border points should not be used as an indicator of efficiency.

If it takes a loaded truck one hour to cover 100 kilometres; a four-hour wait at the border increases the distance to destination to another 400 kilometres. Increased distance impacts on the prices of goods at the retail end hence limiting access to products to majority of Africans. Limited access translates to less freedom of choice — similar to a locked up criminal prisoner.

With modern technology, goods should be declared at point of origin and point of receipt. Border points should simply have scanners to verify the content of containers. Protectionism, tariffs and non-tariff barriers within the continent sustains African market orientation towards former colonisers.

African entrepreneurs are subjected to longer travel schedules due to constant police checks and slow border processes. To fight poverty on the continent, African people would benefit from an African Union Summit that resolves to facilitate efficiency in movement of goods and services. Efficient delivery systems on the continent will tackle challenges of food insecurity, poor health care, conflicts and further promote diversified economies arising from competitive healthy trading amongst and between African nations.

Elimination of tariff and non-tariff barriers to trade will provide an opportunity for African entrepreneurs to adequately take their rightful places as relevant players in the global trade system. It is imperative that African countries re-orient their strategies to promote productivity by reviewing tariffs that hold back entrepreneurs from accessing the continent’s market. This calls for both a competitive spirit and a sense of integrated tariff and process compromise if the continent is to haul its population from poverty. Source: The Herald (Zimbabwe)

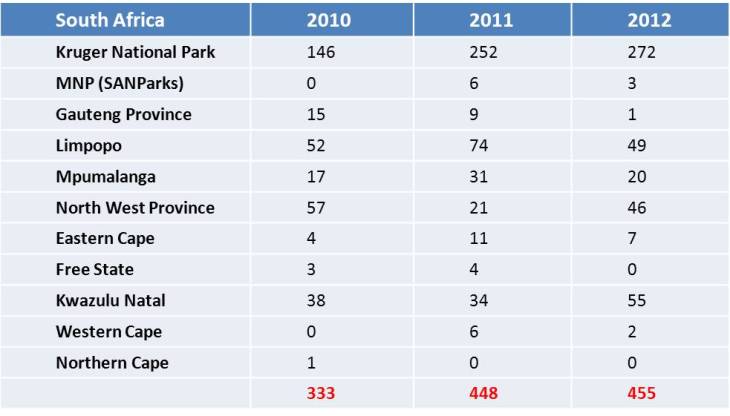

A record number of African rhinos were illegally killed in South Africa this year, driven by the use of their horns in Chinese medicine and a spreading belief in Southeast Asia, unfounded in science, that they may cure cancer. The street value of rhinoceros horns has soared to about $65 000 a kilogramme, making it more expensive than gold.

A record number of African rhinos were illegally killed in South Africa this year, driven by the use of their horns in Chinese medicine and a spreading belief in Southeast Asia, unfounded in science, that they may cure cancer. The street value of rhinoceros horns has soared to about $65 000 a kilogramme, making it more expensive than gold.

You must be logged in to post a comment.