Trucks at Transnet Freight Rail’s City Deep Terminal (Engineering News)

Following up on last year’s meeting (click here!) of the minds, convened by the JCCI, a recent meeting in Johannesburg placed fresh emphasis on the dilemma which impending changes contemplated in Customs Draft Control Bill will have for the import and logistics industry in particular. The following report carried by Engineering News highlights trade’s concerns which are by no means light weight and should be addressed with some consideration before the Bills come into effect. Gauging from the content below, there is a clear disconnect between business and policy makers.

The closure of Johannesburg’s inland port seemed to be a “done deal” as Parliament deliberated the recently tabled Customs Control Bill that would leave the City Deep container depot invalid, Chamber of Commerce and Industry Johannesburg (JCCI) former president Patrick Corbin said on Friday.

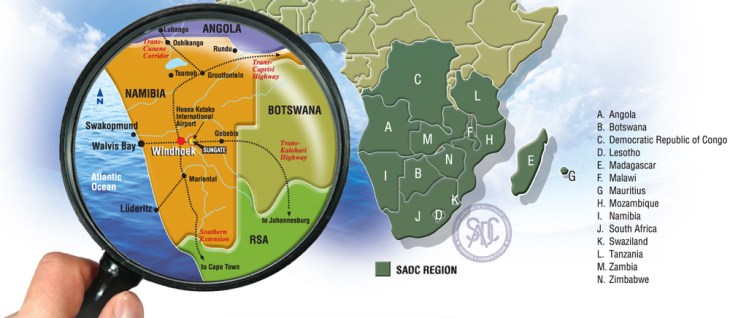

The promulgation of the South African Revenue Services’ (Sars’) newly drafted Customs Control Bill, which, in conjunction with the Customs Duty Bill, would replace the current legislation governing customs operations, would have a far-reaching impact on the cost and efficiencies of doing business in South Africa and other fellow Southern African Customs Union (Sacu) countries, he added.

The Bill, which was the product of a three-year development process within the National Economic Development and Labour Council, declared that all imported goods be cleared and released at first port of entry. This was part of efforts by customs officials and government to root out any diversion and smuggling of goods, ensure greater control of goods moving across borders and eliminate risks to national security.

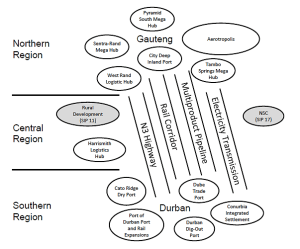

Speaking at the City Deep Forum, held at the JCCI’s offices in Johannesburg, Corbin noted, however, that City Deep had operated as an inland port for the past 35 years, easing the load on the country’s coastal ports, which were already strained to capacity. Despite customs officials assuring the chamber that the operations and facilities in City Deep/Kaserne would retain its licence as a container depot, he believed customs had failed to recognise the critical role City Deep had played in lowering the cost of business, easing the burden on South Africa’s ports and ensuring ease of movement of goods to neighbouring countries. As customs moved full responsibility of container clearances to the ports, port congestion, inefficiencies, shipping delays and costs would rise, and jobs would be lost and import rail volumes decreased, he noted.

Economist Mike Schussler added that the closure of the City Deep inland port operations would add costs, increase unreliability and induce “hassles”, as the Durban port did not have the capacity to handle the extra volumes and its productivity and efficiencies were “questionable” compared with other ports.

“The volume of containers going to overstay or being stopped for examination in City Deep [will] need to be handled by [the coastal] ports. If they can’t cope with the volume at the moment, how are they going to handle increased volumes,” Iprop director Dennis Trotter questioned. He noted that only the containers cleared 72 hours prior to arrival would be allocated to rail transport. Those not cleared three days before arrival would be pushed onto road transport to prevent blocking and delaying rail operations.

This, Schussler said, would also contribute – along with port tariffs and the cost of delays – to higher costs, as road transport was more expensive than rail.

He pointed out that South Africa was deemed third-highest globally in terms of transport pricing. It would also result in less rail capacity returning for export from Johannesburg, further leading to increased volumes moving by road from City Deep to Durban.

Sacu countries, such as Botswana, would also be burdened with higher costs as they relied on City Deep as an inland port. Trotter noted that the region would experience loss of revenue and resultant job losses. Over 50% of South Africa’s economy was located closer to Gauteng than the coastal ports. Johannesburg alone accounted for 34% of the economy, said Schussler, questioning the viability of removing the option of City Deep as a dry port.

However, unfazed by the impending regulations, Transnet continued to inject over R1-billion into expansion and development opportunities at City Deep/Kaserne. Corbin commented that Transnet had accepted the assurances from customs that “nothing would change and the boxes would still be able to move seamlessly once cleared.” The City of Johannesburg’s manager of transport planning Daisy Dwango said the State-owned freight group was ramping up to meet forecast demand of the City Deep/Kaserne depot.

The terminal’s capacity would be increased from the current 280 000 twenty-foot equivalent units (TEUs) a year, to 400 000 TEUs a year by 2016, increasing to 700 000 TEUs a year by 2019. Transnet aimed to eventually move to “overcapacity” of up to 1.2-million TEUs a year. Dwango said projections have indicated that by 2021, the City Deep/Kaserne terminals would handle between 900 000 and one-million TEUs a year. Source: Engineering News

You must be logged in to post a comment.