A rather lengthy article published by Third World Network, but entirely relevant to trade practitioners and international supply chain operators who may desire a layman’s understanding of the issues and challenges presented by the WTO’s proposed agreement on ‘Trade Facilitation’. I have omitted a fair amount of the legal and technical references, so if you wish to read the full unabridged version please click here! If you are even more interested in the subject, take a look through the publications available via Google Scholar.

A rather lengthy article published by Third World Network, but entirely relevant to trade practitioners and international supply chain operators who may desire a layman’s understanding of the issues and challenges presented by the WTO’s proposed agreement on ‘Trade Facilitation’. I have omitted a fair amount of the legal and technical references, so if you wish to read the full unabridged version please click here! If you are even more interested in the subject, take a look through the publications available via Google Scholar.

A group of eminent trade experts from developing countries has advised developing countries to be very cautious and not be rushed into an agreement on trade facilitation (TF) by the Bali WTO Ministerial Conference, given the current internal imbalance in the proposed agreement as well as the serious implementation challenges it poses.

“While it may be beneficial for a country to improve its trade facilitation, this should be done in a manner that suits each country, rather than through international rules which require binding obligations subject to the dispute settlement mechanism and possible sanctions when the financial and technical assistance as well as capacity-building requirements for implementing new obligations are not adequately addressed.”

This recommendation is in a report by the Geneva-based South Centre. The report, “WTO Negotiations on Trade Facilitation: Development Perspectives”, has been drawn up from discussions at two expert group meetings organised by the Centre.

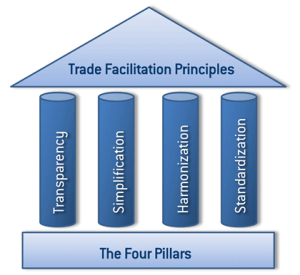

Noting that an agreement on trade facilitation has been proposed as an outcome from the Bali WTO Ministerial Conference, the South Centre report said that the trade facilitation negotiations have been focused on measures and policies intended for the simplification, harmonization and standardization of border procedures.

“They do not address the priorities for increasing and facilitating trade, particularly exports by developing countries, which would include enhancing infrastructure, building productive and trade capacity, marketing networks, and enhancing inter-regional trade. Nor do they include commitments to strengthen or effectively implement the special and differential treatment (SDT) provisions in the WTO system”.

The negotiations process and content thus far indicate that such a trade facilitation agreement would lead mainly to facilitation of imports by the countries that upgrade their facilities under the proposed agreement. Expansion of exports from countries require a different type of facilitation, one involving improved supply capacity and access to developed countries’ markets.

Some developing countries, especially those with weaker export capability, have thus expressed concerns that the new obligations, especially if they are legally binding, would result in higher imports without corresponding higher exports, which could have an adverse effect on their trade balance, and which would therefore require other measures or decisions (to be taken in the Bali Ministerial) outside of the trade facilitation issue to improve export opportunities in order to be a counter-balance to this effect.

According to the report, another major concern voiced by the developing countries is that the proposed agreement is to be legally binding and subject to the WTO’s dispute settlement system. This makes it even more important that the special and differential treatment provisions for developing countries should be clear, strong and adequate enough. The negotiations have been on two components of the TF: Section I on the obligations and Section II on special and differentiated treatment (SDT), technical and financial assistance and capacity building for developing countries.

Most developing countries, and more so the poorer ones, have priorities in public spending, especially health care, education and poverty eradication. Improving trade facilitation has to compete with these other priorities and may not rank as high on the national agenda. If funds have to be diverted to meet the new trade facilitation obligations, it should not be at the expense of the other development priorities.

“Therefore, it is important that, if an agreement on trade facilitation were adopted, sufficient financing is provided to developing countries to meet their obligations, so as not to be at the expense of social development,” the report stressed.

The report goes on to highlight the main issues of concern for a large number of developing countries on the trade facilitation issue. It said that many developing countries have legitimate concerns that they would have increased net imports, adversely affecting their trade balance. While the trade facilitation agreement is presented as an initiative that reduces trade costs and boosts trade, benefits have been mainly calculated at the aggregate level.

Improvements in clearance of goods at the border will increase the inflow of goods. This increase in imports may benefit users of the imported goods, and increase the export opportunities of those countries that have the export capacity.

However, the report noted, poorer countries that do not have adequate production and export capability may not be able to take advantage of the opportunities afforded by trade facilitation (in their export markets).

“There is concern that countries that are net importers may experience an increase in their imports, without a corresponding increase in their exports, thus resulting in a worsening of their trade balance.”

Many of the articles under negotiations (such as the articles on ‘authorized operators’ and ‘expedited shipments’) are biased towards bigger traders that can present a financial guarantee or proof of control over the security of their supply chains. There is also the possibility that lower import costs could adversely affect those producing for the local markets.

“The draft rules being negotiated, mainly drawn up by major developed countries, do not allow for a balanced outcome of a potential trade facilitation agreement,” the report asserted.

New rules under Section I are mandatory with very limited flexibilities that could allow for Members’ discretion in implementation. The special and differential treatment under section II has been progressively diluted during the course of the negotiations. Furthermore, while the obligations in Section I are legally binding, including for developing countries, developed countries are not accepting binding rules on their obligation to provide technical and financial assistance and capacity building to developing countries.

The trade facilitation agreement would be a binding agreement and subject to WTO dispute settlement. The negotiating text is based on mandatory language in most provisions, which includes limited and uncertain flexibilities in some parts.

Therefore, if a Member fails to fully implement the agreement it might be subject to a dispute case under the WTO DSU (Dispute Settlement Understanding) and to trade sanctions for non-compliance.

“Many of the proposed rules under negotiations are over-prescriptive and could intrude on national policy and undermine the regulatory capacities and space of WTO Member States. The negotiating text in several areas contains undefined and vague legal terminology as well as ‘necessity tests’, beyond what the present GATT articles require.”

Continue reading →

You must be logged in to post a comment.