Bromma load verification sensing technology (www.bromma.com)

The International Association of Ports and Harbours (IAPH) has helped the container handling industry to put focused attention on the issue of container weight verification. The IAPH and the International Shipping Organization have called for near 100 per cent container weight verification as a standard industry ‘best practice’. IAPH has recognised the value of container weight verification for both safety and operational reasons. Accurate container weights can help guide critical plans regarding stowage, and verifiable load data also serves to ensure worker safety. Lifting containers within an acceptable weight range also prevents accelerated stress on the spreader, thus extending equipment life.

The issue that organisations such as IAPH and the World Shipping Council have raised is not merely an academic one, studies of container weight indicate that there is often significant variation between listed and actual container weight. The problem is a familiar one: not everyone tells the truth about their weight, as the consequences of inaccurate weight can include equipment damage in ports, injury to workers and collapsed container stacks, among others.

The question is ‘how’, not ‘should’?

The general consensus has grown that universal container weight verification is a worthy standard, the key question has quickly begun to shift from whether we should we have a universal requirement to how we can best implement this commitment. Along these lines three general approaches might be possible.

The container crane option

The first possible approach is to utilise container cranes to meet the weighing requirement. The advantage of weight verification by cranes is that weighing occurs during the normal course of handling operations. The disadvantage of a crane-based approach is that weighing accuracy is only approximately 90-95 per cent, and cranes cannot distinguish between the weights of two containers when lifting in twin-mode. Since many terminals load and unload container ships using twin-lift/twin-20 foot spreaders, the actual weight of each of these individual containers will remain in doubt if there is a reliance on container cranes to yield this data. Also, with the emergence of the mega-ship era, more and more terminals will be looking for productivity solutions that enable more containers to be handled in each lift cycle, and so twin-handling of 40 and 20 foot containers is likely to expand in the future, thus adding to the number of containers with an uncertain weight.

The weigh bridge option

A second option for terminals would be to meet the container weight requirement through the use of weigh bridges. Unfortunately, there are multiple weaknesses in this approach.Containers can be weighed from the weigh bridge, but driving every container onto a weigh bridge will obviously add another operational step, and slow productivity. It also requires, especially at larger and busier transhipment terminals, that considerable land and transit lanes be set aside for weighing activities. In addition, there are two weight variables on the weigh bridge – the variable weight of up to 300 litres of truck fuel and the weight of the driver. Further, as with a container crane, a weigh bridge cannot distinguish between the weights of two containers, and so the weight of each individual container will always be inexact. The only way to gain a precise weight is to weigh one container at a time, and to adjust for fuel weight and driver weight variables.

The spreader twist lock option

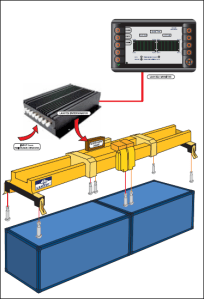

The third option is to ascertain container weight from the spreader twist locks. For container terminals, a spreader-based weighing approach has several key advantages. Firstly, weighing from the spreader twist locks yields much more accurate information, as container weight precision is greater than 99 per cent. Secondly, unlike weigh bridges or crane-based container weighing, spreaders weigh each container separately when operating in twin-lift mode. When a Bromma spreader lifts two 20 foot containers or two 40 foot containers at a time, the spreader can provide highly accurate data on the weight of each separate container, and without any of the variables (fuel, driver) associated with the weigh bridge approach.

In addition, with a spreader-based approach you weigh containers from the spreader twist locks without adding any extra operational steps or requiring any extra space or transit lanes. Terminals simply log container weights in the normal course of lifting operations – with a warning system alerting the terminal to overloaded and eccentric containers. Container weight verification during the normal course of terminal operations is a way to accomplish the weighing mission without impairing terminal productivity, and especially at busy transhipment terminals. To read the full report, Click Here!

Source: www.porttechnology.org

You must be logged in to post a comment.