Martin Gobizandla Dlamini, the new Minister of Finance, is aware of the challenges of the country’s economy in case South Africa pulls out of the Southern African Customs Union (SACU).

Martin Gobizandla Dlamini, the new Minister of Finance, is aware of the challenges of the country’s economy in case South Africa pulls out of the Southern African Customs Union (SACU).

However, the minister warned against pressing the panic button. He said there were no pellucid pointers that South Africa might pull out of the union.

Asked what measures were in place to sustain the country economically if South Africa pulled out or reviewed the revenue sharing formula to the negative, he said: “Let us cross the bridge when we get there. I am aware that South Africa calls for changes in the revenue sharing formula. This is a matter that has been on the table for quite some time.”

“I can’t comment now on how to survive with or without SACU receipts but I can mention that we are a sovereign state.” He did not expand on the sovereignty of Swaziland. Dlamini said SACU member states would meet in February 2014 for a strategic session.

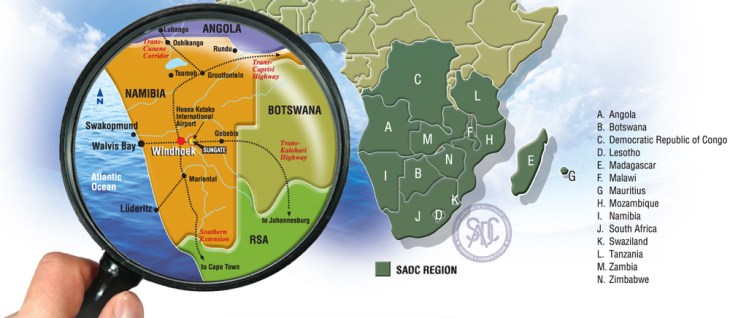

These are South Africa, Namibia, Swaziland and Lesotho. “We were to meet in February in the first place, to discuss strategies on how to modernise SACU and make it relevant to our needs. It’s not like we are going there for shocks or breaking news about South Africa’s position on SACU,” said Dlamini, the former Governor of the Central Bank of Swaziland.

The country’s Gross Domestic Product (GDP) stands at E37 billion for 2012 while that of South Africa is E3.8 trillion as at 2012. In the absence of SACU, Swaziland is left with a few companies that add value to the economy in terms of taxes. They include among others Conco Swaziland which is understood to be contributing 40 per cent to the GDP, which translates to E14.9 billion and the sugar belt companies; Royal Swaziland Sugar Corporation (RSSC) which makes a turnover in excess of E1 billion and Illovo Group’s subsidiary Ubombo Sugar Limited (USL). Illovo Sugar has a 60 per cent shareholding at Ubombo Sugar while the remaining 40 per cent is held by Tibiyo Taka Ngwane, a royal entity held in trust for the Swazi nation. To Illovo Group’s profits, Ubombo Sugar contributed E272 million.

Bongani Mtshali, the acting Chief Executive Officer (CEO) of the Federation of Swaziland Employers and Chamber of Commerce (FSE&CC), said the country could be in a very bad economic situation if South Africa were to pull out of SACU. He said the economic problem could still persist even if the revenue derived from the union was decreased. Mtshali advised Swazis to expand the revenue base and work hand in hand with the Swaziland Revenue Authority (SRA) in its collection of domestic taxes.

The taxes include company tax, pay-as-you-earn, sales tax, casino tax and value added tax. He said people and companies should be encouraged to honour tax obligations. He also called for business innovation. “We will be able to produce and sell if we innovate,” he said. He said there was a need to have an innovation institution of some sort to produce talent, nurture and release it for productivity.

As it were, he said, it was suicidal to depend entirely on SACU revenue. It can be said that over 60 per cent of the country’s budget comes from the union. The SRA collects over E3 billion and this money cannot finance the national budget of E11.5 billion.

Ministries that can save Swaziland from an economic crisis are the Ministry of Commerce, Trade and Industry; Ministry of Agriculture, Ministry of Natural Resources and Energy and the Ministry of Economic Planning and Development.

It can be said that Swaziland is an agricultural economy but the closure of the factory at SAPPI Usuthu and destruction of timber at Mondi by veld fires, spelled doom to the economic outlook of the country. It can also be said that the country’s mainstay product is now sugar.

Despite maize being the country’s staple food, government spent E123 million on maize imports from South Africa last year. This year, preliminary figures indicated that government could spend E95 million on maize imports.

The import price has decreased because the country recorded a higher maize harvest of 82 000 metric tonnes compared to 76 000 tonnes recorded the previous year.

Swaziland is still clutching at straws in terms of food security. The unemployment rate is also high as there had been no massive investments witnessed on the shores.

Jabulile Mashwama, Minister of Natural Resources and Energy, said there were plans to expand the mining sector and reopen closed ones like Dvokolwako Diamond Mine.

There are only two official mines currently operational; Maloma Colliery, which made an export revenue of E126 million in the 2011/2012 financial year and Salgaocar which extracts iron ore from dumps at Ngwenya Iron Ore Mine.

Mashwama, the minister, said she would give details on the programme to revive the mining sector at a later stage. She hinted that the nation could also bank its hopes on her ministry for job creation and revitalisation of the economy.

Gideon Dlamini, the Minister of Commerce, Trade and Industry, has been given a task to industrialise the economy as one of the five-point plan by SACU. The industry minister was reported out of the country and was not reachable through his mobile phone. Source: Times of Swaziland

You must be logged in to post a comment.