With recent developments regarding the proposed Durban dug-out port, a colleague of mine shared this gem of an article.

Vetch’s pier (Durban, South Africa) has redeemed itself by becoming a marine sanctuary. Historically, however, it is an expensive relic, a monument to flawed planning, poor workmanship and economic frustration.

Although potentially a major seaport, Durban’s bay was little more than an inaccessible lagoon before dredging and the construction of the north and south piers over a century ago unlocked its real worth. Nature guarded its entrance in the form of shifting sandbanks which made access to the safety of the inner harbor unpredictable and hazardous. As a result entry was restricted to small vessels drawing less than three metres of water. All other shipping had to anchor offshore and endure the extremes of wind and sea. Not surprisingly 66 ships were blown ashore on Durban’s beachfront between 1845 and 1885.

It was obvious from the outset to the British settlers that Natal’s economic prospects depended on the development of Durban harbour. For almost 50 years from 1850 the ‘harbour issue’ was the hardy annual of Natal politics and the correspondence columns of newspapers. Various plans were put forward, that of Captain James Vetch gaining the approval of Governor John Scott in 1857. Vetch, an engineer attached to the Admiralty in London, never actually visited Durban, yet he produced a report and plan to improve the harbour. Despite misgivings, it was rushed through the Natal legislature in October 1859 along with its hefty price tag -£165,000.

Vetch’s solution was to enclose the natural entrance to the harbour by means of two breakwaters, one curving northwards from the base of the Bluff headland and the other curving southwards from present day Ushaka beach. Besides the engineering challenge which that posed, Vetch’s plan ignored the prevailing wind an ocean current directions. But in August 1861 when construction of the northern breakwater commenced, such concerns were lost amidst the optimism of a growing economy and the belief that Vetch’s plan would resolve the frustrations of navigating the entrance to the harbour. A comment in the Natal Mercury on 13 July 1861 summed up the buoyant mood of colonists when it stated that Vetch’s plan would herald ‘new circumstances and be the scene of a busy, all pervading and prosperous industry.

Vetch’s solution was to enclose the natural entrance to the harbour by means of two breakwaters, one curving northwards from the base of the Bluff headland and the other curving southwards from present day Ushaka beach. Besides the engineering challenge which that posed, Vetch’s plan ignored the prevailing wind an ocean current directions. But in August 1861 when construction of the northern breakwater commenced, such concerns were lost amidst the optimism of a growing economy and the belief that Vetch’s plan would resolve the frustrations of navigating the entrance to the harbour. A comment in the Natal Mercury on 13 July 1861 summed up the buoyant mood of colonists when it stated that Vetch’s plan would herald ‘new circumstances and be the scene of a busy, all pervading and prosperous industry.

The site engineer, George Abernethy, encountered difficulties with Vetch’s plan from the outset. The method of construction was impractical: sections of wooden framework filled with rubble simply collapsed in the surf, moreover, the contractor, Thomas Jackson, lacked the capacity to carry out the construction. Early in 1863 it was apparent that the six year project was stalled. Yet £90,000 of the budgeted £165,000 had been spent while less than ten percent of the work had been completed. Financial reasons and poor construction methods saw Vetch’s pier abandoned in 1864. In time the ocean reduced it to what it is today. Both in design and placement, the small craft harbour now being proposed ignores the same natural forces that made Vetch’s plan impractical. Besides, it specifically ignores the pounding effects of the cyclone swells which emanate occasionally from the Mozambique channel.

In May 1864 a furious Natal Legislative Council demanded a detailed report on the Vetch project. In June the contractor walked off the job and left Natal. The Report tabled in August proved an embarrassing indictment. It found that no oversight had been exercised by Treasury officials on certificates for amounts payable and that the contractor had received payments in excess to that which he was entitled. It was also noted that freight for some materials had been paid for twice; that material had been ordered which was in excess of actual needs. To top it all, £113,500 or 70 percent of the allocated budget, had been spent on a project that was scarcely 20 percent complete and the problem of accessing Durban harbour was no closer to resolution.

Far from invigorating Natal’s economy, the submerged finger of an incomplete pier named after its designer, Captain Vetch, proved a drain on the colonial treasury for years to come, interest on the loan for the project amounting to about 17 percent of total revenue. A project born out of economic frustration left a legacy of even greater economic frustration. Until the 1880s Durban harbour languished having gained a reputation as a port of high charges and long delays. But from 1886 when dredging operations began, followed by extension of the breakwaters, the depth of the entrance channel improved. By 1892 it averaged over four metres allowing larger ships to cross the bar.

But the way forward was dogged by controversy. Two camps developed: one which saw the solution in dredging, the other in the extension of the north pier. So great was the agitation that it led to the fall of the government of Harry Escombe in October 1897. Ultimately, a combination of the scour facilitated by the north and south piers and the effects of dredging resolved access to Durban harbour. In 1904, the Armadale Castle, drawing 6,7 metres of water, became the first mail-steamer to enter the port.

Although incomplete and a non-starter, the remains of Vetch’s pier should serve as a reminder of the power of the ocean and the need for fearless scrutiny of public projects. Source: Duncan Du Bois (Ward Councillor) and Facts About Durban

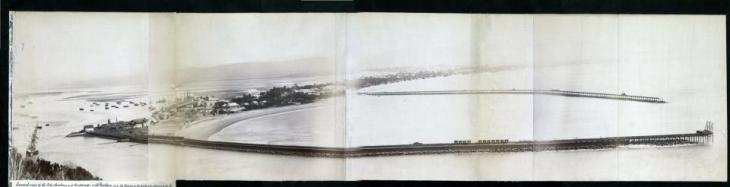

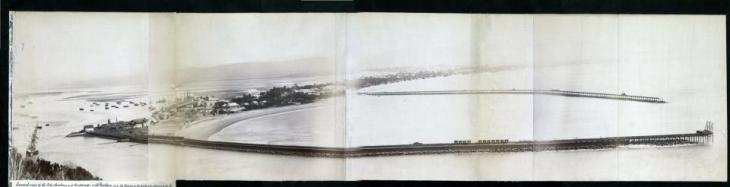

A tad of nostalgia? No, this is relevant and historic. Look what Africa’s busiest seaport looked like 60 (or more) years ago. I am very grateful to Lois Crawley and Cecil Gaze (fellow customs colleagues in Durban) for sharing these historic gems. For purposes of contrast see the modern-day harbour (above). Real estate in the harbour area is in short-supply and significant operational expansion over the last 10 years has placed huge strain on the road and rail networks and the surrounding industrial areas. In recent times the expansion of containerised handling facilities has radically affected the traffic flows, even in nearby residential areas such as the Bluff. With increasing demand for premium containerised port handling facilities, the old Durban airport has been sited for development of a new port, perhaps the biggest and most ambitious construction project yet in South Africa. While one can marvel at the development over what is a relatively short period of time (a generation), spare a moment and view the seemingly archaic slideshow of Durban harbour purportedly between 1940 and 1960 – which some amongst us can even remember. Enjoy!

A tad of nostalgia? No, this is relevant and historic. Look what Africa’s busiest seaport looked like 60 (or more) years ago. I am very grateful to Lois Crawley and Cecil Gaze (fellow customs colleagues in Durban) for sharing these historic gems. For purposes of contrast see the modern-day harbour (above). Real estate in the harbour area is in short-supply and significant operational expansion over the last 10 years has placed huge strain on the road and rail networks and the surrounding industrial areas. In recent times the expansion of containerised handling facilities has radically affected the traffic flows, even in nearby residential areas such as the Bluff. With increasing demand for premium containerised port handling facilities, the old Durban airport has been sited for development of a new port, perhaps the biggest and most ambitious construction project yet in South Africa. While one can marvel at the development over what is a relatively short period of time (a generation), spare a moment and view the seemingly archaic slideshow of Durban harbour purportedly between 1940 and 1960 – which some amongst us can even remember. Enjoy!

You must be logged in to post a comment.