Herewith a collection of articles on customs non-intrusive inspection around the world. True to form, the acquisition and use of such technology is not without controversy of some sort.

Spanish Customs to use ‘Full-body See-through’ Scanner at Frontier

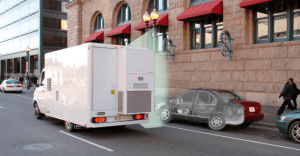

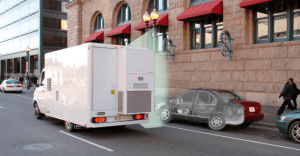

American Science and Engineering’s (AS&E) Z Backscatter Van

July 2013 – The Spanish Government is to deploy a ‘Mobile X-Ray Scanner’ at the frontier to detect cross-frontier smuggling of tobacco. A Panorama Investigation reveals the mobile X-ray scan technology mentioned is one installed and operated in a mobile vehicle (van) – it is system that is potentially dangerous!

These plans are said to be part of a strategy to crack-down on cigarette smuggling across the frontier, which they say is causing untoward damage to the Spanish economy. The regional special representative of ‘La Agencia Tributaria’ (Spanish Tax) Alberto García Valera, says he has found it necessary to spend money and invest heavily on new technologies to combat fraud and tax evasion in places like the Le Linea-Gibraltar Frontier.

‘La Agencia Tributaria’ purportedly placed an order with the American company American Science and Engineering (AS&E) for the delivery of this very sophisticated, hi-tech scan system known as the ZBV S-Class.

The ZBV or Z Backscatter Van, is a mobile X-ray vehicle screening system, it uses technology known as ‘Backscatter’ which provides a photo-like images of concealed objects, such as explosives, drugs, currency trade-fraud items and of course things like cigarettes, but the latter not exclusively so.

The ZBV X-Ray Scanning equipment is integrated into a standard van type vehicle, usually powered by a Mercedes or Chrysler engine. The ZBV creates a photo-like Z Backscatter images showing materials by directing a sweeping beam of X-rays at the object under examination, and then measuring and plotting the intensity of scattered X-rays…if you’re in your car, your body will get zapped by the X-Ray beams!

Read the full report by Panaorama (Gibralter) here!

Axis Cams Integrated with X-ray Scanners Secure Korean Airport Customs

Korean Customs Integrated Control Room – Gimhae International Airport

November 2013 – Korean Customs at Gimhae International Airport , Busan has introduced Axis network cameras and integrated it with the existing X-ray scanners for checked bags into one location. This has allowed Customs to manage its workforce more efficiently and enhance its monitoring capabilities through the “Choose and Focus” function.

An integrated X-ray viewing room has allowed Korean Custom’s management to divide the workforce into teams of two, and the accuracy of reading and individuals’ reading capabilities have been significantly improved. Since the reading staff has been grouped into teams, their level of fatigue has been reduced, and they can concentrate and read multiple X-ray scans at all times.

Network Cameras with panoramic function in each carousel monitor the CIQ customs, immigration and quarantine area that passengers must go through when departing or arriving. The cameras now permit Customs to accurately track and monitor travellers as they claim their baggage. All stages from Check-in of checked bags to their check-out are carefully recorded, resulting in disputes with travelers about lost or damaged bags can be smoothly resolved. The high-definition network cameras allow the entire route to be monitored for abnormal cargo. It is much easier to identify risks and monitor movement during incidents. Read the full report here! Source: asmag.com

Nigeria Customs takes inventory, evaluates scanning machines ahead of takeover

Nigeria Customs takes inventory, evaluates scanning machines ahead of takeover

October 2013 – Nigeria Customs Service (NCS) has begun an inventory and evaluation of the scanning machines with a view to ascertaining the state of the machines ahead of the December 1, take over date.

In an exclusive interview with Vanguard at the Customs Headquarters in Abuja, service spokesman, Mr. Adewale Adeniyi, a Deputy Comptroller of Customs said that consultants and experts including the manufacturers of the scanners (Smith of France) were all brought to carry test of the machines.

Adeniyi also said that more than 500 of the newly recruited men and officers of the service will be deployed to both the information technology and scanning departments. He disclosed that in the course of evaluating the machines, it was discovered that maintenance of the scanners had been compromised.

He added that the development will not in any way stop the take over of the scanning machines by the Nigerian Customs Service. The Customs spokesman disclosed that the maintenance of the machines were sub-contracted to other consultants other than the manufacturers.

Adeniyi further disclosed that the integrity of the machines in terms of maintenance have been compromised. Source: www.energymixreport.com

Nicaragua – Fixed Rate to be Charged for Customs Scanning (Fail!)

Port of Corinto, Nicaragua (Picture: Wikipedia)

July 2013 – The government has recognized that it was a mistake charging for the scanner service based on the value of the cargo.

The presidential adviser for economic affairs, Bayardo Arce, believes the head of the Directorate General of Customs (DGA), Eddy Medrano, may have overstepped the mark in approving a contract with the company Alvimer Internacional y Compañía Limitada on the right to collect on the declared value of the goods that pass through the scanner system to be installed in the country’s customs offices.

“We have been made aware of this criterion of entrepreneurs and talked with President … and it is clear that a technical error was made,” the official, adding that the fee collected will be at a fixed rate as in the draft Law on Granting of Non Intrusive Inspection Services in National Security Border Controls, prior to the approval of Congress.

The concessionaire in charge of scanning services in Nicaraguan customs offices would recover its investment in 15 months and earn $220 million in the 15 year contract.

From all this money, 10% will go to the Directorate General of Customs (DGA). According to preliminary calculations made by the Nicaraguan private sector, the company will invest about $22.4 million in the seven scanners to be installed in each of the seven Nicaragua customs offices, recovering its investment in just 15 months. Source: centralamericadata.com

![The Mauritius Coast Guard flagship MCGS Vigilant [www.defenceweb.co.za]](https://mpoverello.com/wp-content/uploads/2014/06/the-mauritius-coast-guard-flagship-mcgs-vigilant-defenceweb-co-za.jpg?w=300&h=225)

You must be logged in to post a comment.