Port of Antwerp has issued its 2013 Annual Report which contains an interesting ranking of the largest ports worldwide.

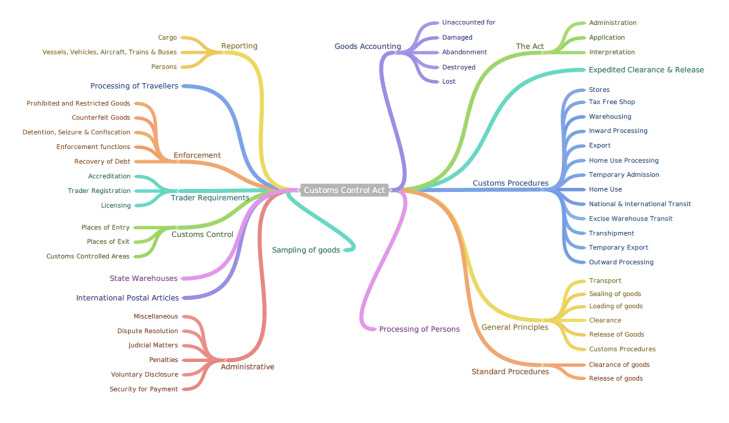

According to the Port of Antwerp, throughput figures of different ports cannot be compared as ports do not use uniform definitions: some ports (most importantly Singapore) apparently use freight tons (metric tons or volume tons, whichever is higher).

According to Antwerp’s estimates, Singapore handles slightly more than 400m tons, instead of the 560m tons reported by the Maritime and Ports Authority of Singapore. However, their ‘correction factor’ may not be accurate.

Port of Antwerp’s definition of throughput is focused on ‘international throughput’. That is a debatable definition, as it leads to the exclusion of domestic traffic by seagoing vessels. For this reason, and partly because the Chinese ports apparently also include barge traffic in total volumes, the Chinese ports of Shanghai and Ningbo are substantially smaller in Antwerp’s figures than in their own statements.

So, surprisingly, the largest port of the world according to Antwerp’s annual report is Rotterdam! This goes to show that their effort is not intended as a marketing effort to favour Antwerp. If that was the case, they could have taken the port area to identify the largest port. This indicator puts Antwerp firmly on top as Europe’s largest port, with about 13,000 hectares, compared with Rotterdam’s more than 10,000 hectares. But clearly, the port area is an indicator of limited value, both due to differences in the definitions and for its limited relevance.

The Antwerp ranking does demonstrate the variety of definitions used in measuring port throughtput. For instance, in Europe ports throughput numbers do not fully match with Eurostat’s throughput data. This variety of definitions does not only apply to throughput, but also for other indicators such as modal split and employment in ports. That hampers international comparisons, benchmarking as well as academic research.

An authorative effort to create global standards would be good news for the port industry. Source: Porttechnology.com

![Port of Antwerp [Picture - Porttechnology.com]](https://mpoverello.com/wp-content/uploads/2014/05/port-of-antwerp-picture-porttechnology-com.jpg?w=730&h=475)

![According to observers, some of the ships that appear in the table above (Alphaliner) with a flow rate of 19 official thousand TEUs could in fact could also load a thousand more. [http://www.lagazzettamarittima.it/]](https://mpoverello.com/wp-content/uploads/2014/04/alphaliner-2-2014g.jpg?w=300&h=180)

You must be logged in to post a comment.