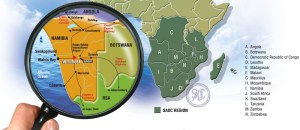

Engineering News reports that Gauteng will require additional container terminal capacity by 2016, when City Deep, in Johannesburg, will reach its full capacity. Container movements to the province was projected to grow to over three-million twenty-foot equivalent units (TEUs) a year by 2020, she said in her Budget Vote address at the Gauteng Provincial Legislature. Gauteng’s intermodal capacity currently stood at 650 000 TEUs a year and comprised the Pretcon, Vaalcon, Kascon and City Deep hubs.

Engineering News reports that Gauteng will require additional container terminal capacity by 2016, when City Deep, in Johannesburg, will reach its full capacity. Container movements to the province was projected to grow to over three-million twenty-foot equivalent units (TEUs) a year by 2020, she said in her Budget Vote address at the Gauteng Provincial Legislature. Gauteng’s intermodal capacity currently stood at 650 000 TEUs a year and comprised the Pretcon, Vaalcon, Kascon and City Deep hubs.

Gauteng MEC for Economic Development, Qedani Mahlangu said the next generation of inland hubs would create an integrated multimodal logistics capability connecting air, road, rail and sea. Tambo Springs and Sentrarand, in Ekurhuleni, were identified to be developed into the new improved hubs.

By 2018, Tambo Springs would handle 500 000 TEUs and will focus on economic development and job creation, among others. “Tambo Springs will serve as an incubator to stimulate the establishment and growth of new ventures, create opportunities for small, medium-sized and micro enterprises and create 150 000 new jobs,” Mahlangu said.

She added that the department was working towards reaching an agreement with State-owned Transnet in September so that funding could be committed to start implementation by June 2013, for the first phase, which would comprise the railway arrival and departure terminal, to be completed by March 2014.

As per the Gauteng Employment, Growth and Development Strategy, freight and logistics were key drivers in stimulating sustainable growth in the province and the country. “Logistics efficiency will have positive spin-offs to the country‘s ability to export and import goods. In terms of freight, the intention is to move to rail… thereby reducing congestion on roads, air pollution and the impact on the surface of roads. The overall objective is to optimise Gauteng as the gateway to the emerging African market,” Mahlangu said. Source: Engineeringnews.co.za

Related articles

- New Durban dug-out Port – tenders released (mpoverello.com)

- 11,660-TEU container ship due in Durban (shippingnewsandviews.wordpress.com)

You must be logged in to post a comment.