The winner of this year’s WCO Photo Competition will be announced this Saturday, 7 July 2017. To see the submissions of all this year’s entrants, please click here! See if you can identify the winner. Source: WCO

The winner of this year’s WCO Photo Competition will be announced this Saturday, 7 July 2017. To see the submissions of all this year’s entrants, please click here! See if you can identify the winner. Source: WCO

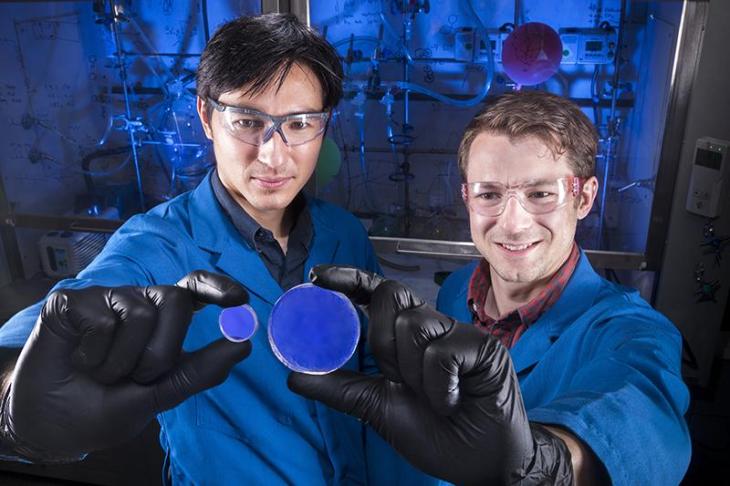

Researchers at Sandia National Laboratories have developed new glass scintillators to detect suspicious nuclear material at borders and ports. The new scintillators are cheap, effective and more stable than the current scintillators in use.

Scintillators, which produce bright light when struck by radiation, are used extensively by the US Government in homeland security as radiation detectors. By observing the amount of light produced, and how quickly, the source of radiation may be identified.

Dr Patrick Feng, who led the Defense Nuclear Nonproliferation project, began to develop new types of scintillators in 2010, in order to “strengthen national security by improving the cost-to-performance ratio of radiation detectors”. To improve this ratio, he had to “bridge the gap” between effective scintillators made from expensive materials, and affordable but far less effective models.

Although there are many types of scintillator available, the best-performing scintillators are made from trans-stilbene. This crystallised form of a molecule allows border security tell the difference between gamma rays, which appear naturally everywhere, and neutrons, which are often associated with threatening materials such as plutonium and uranium, by producing a bright light in response.

The gold standard scintillator material for the past 40 years has been the crystalline form of a molecule called trans-stilbene, despite intense research to develop a replacement. Trans-stilbene is highly effective at differentiating between two types of radiation: gamma rays, which are ubiquitous in the environment, and neutrons, which emanate almost exclusively from controlled threat materials such as plutonium or uranium. Trans-stilbene is very sensitive to these materials, producing a bright light in response to their presence.

These crystals, however, are too fragile and expensive (around S1,000 per cubic inch) to be used in the field, and instead, security personnel will tend to use plastic-based scintillators, which can be moulded into large shapes but are ineffective at differentiating between different types of radiation or detecting weak sources.

In order to find a good alternative, Dr Feng and his team at Sandia National Laboratories in Livermore, CA, began to experiment with organic glass components, which are capable of discriminating between different types of radiation.

Tests demonstrated that scintillators made with organic glass performed even better than the trans-stilbene scintillators in radiation detection tests.

The researchers were able to improve their design further when they drew a parallel between the behaviour of LEDs, which produce light when electrical energy is applied, and scintillators, which respond to radioactive sources. They found that adding fluorine, which is used in some LEDs, into the scintillator components helped stabilise them. This allowed for the organic glass to be melted down and cast into large blocks without becoming cloudy or crystallising upon cooling.

The result was an indefinitely stable scintillator able to differentiate between non-threatening radioactive sources, such as those used in medical treatments, and those which could constitute threats. The organic glass components are cheap and easy to manufacture, and do not degrade over time.

Next, the researchers will cast a large prototype for field testing, and hopefully demonstrate that the scintillator can withstand environmental wear and tear, for instance, due to the humidity of ports where checks are carried out. They also hope to adjust the scintillator to distinguish between safe sources of gamma radiation, and those which could be used to make “dirty bombs”. Source: Sandia Laboratory

Customs and Border Protection is analyzing the distance between travelers’ eyes and the width of their foreheads to better track international travelers.

This week the agency began using facial recognition technology at Bush Intercontinental Airport on one daily flight departing Houston for Tokyo.

“The use of biometrics is approaching an almost everyday type of experience,” said Henry Harteveldt, founder of San Francisco-based Atmosphere Research Group, a travel industry research company. “It’s much more common now than it was 10 to 20 years ago.”

Similar technology is increasingly used everywhere. For instance, fingerprints are used to unlock phones and access secure banking information. Facebook can automatically recognize and tag friends in photos. And a variety of airport entities, ranging from airlines to the Transportation Security Administration, also are using biometric data to enhance security and expedite traveling.

Some still question the reliability of facial recognition technology, but it has evolved over the years and continues improving.

Delta and JetBlue recently announced collaborations with Customs and Border Protection to integrate facial recognition technology as part of the boarding process. And Customs began piloting its own facial recognition technology in June 2016 at Hartsfield-Jackson Atlanta International Airport. The technology then was rolled out at Washington Dulles International Airport in May 2017, and seven additional airports will receive the technology in the next several months.

Customs “sees potential for the technology to transform the travel process provided privacy issues can be addressed,” an agency spokesperson said in an email.

“The use of biometrics to confirm identity from the beginning to the end of travel has the potential to reduce the frequency travelers have to present travel documents throughout the airport.”

Currently, the system takes pictures of individual travelers right before they board an international flight. That photo is then compared with a flight-specific photo gallery Customs and Border Protection created using travel documents passengers provided to the airline.

Officials say capturing this type of biometric information will ensure travelers aren’t lying about their identity. And the agency spokesperson emphasized that Customs worked closely with its privacy office. If the photo captured at boarding is matched to a U.S. passport, the photo of that traveler – having been confirmed as a U.S. citizen – is discarded after a short period of time.

“I don’t think there’s going to be any resistance by consumers to this,” Harteveldt said, “provided they’re given very clear explanations about what information is being collected, why it’s being collected and a high-level understanding of the safeguards that will be taken to keep their biometrics data safe and secure.”

Opinions vary on whether capturing such data from departing travelers will boost security or hurt airlines’ on-time performance. But the point is moot. Laws requiring exit control have been on the books for many years.

“It is already required by law, and it has taken way too long to implement an effective exit technology,” said Andrew Arthur, resident fellow in law and policy at the Center for Immigration Studies, a Washington, D.C.-based think tank that pushes for stricter immigration controls.

He said monitoring foreign travelers as they leave the U.S. helps enforce immigration laws. And if visitors enter the country legally but officials later realize they pose a threat, this exit system will tell officials if they are still in the U.S.

Harteveldt, however, said passport and visa information is already collected when travelers leave the country. He doesn’t believe biometrics are needed.”I’m just not sure it adds a lot of value to the exit process,” he said.

But compared with fingerprint technology, Harteveldt said facial scanning can be faster and cleaner. There’s no need to touch anything. Customs officers at Bush Intercontinental began taking the fingerprints of some departing international travelers in 2015.

Anthony Roman, president of global investigation and risk management firm Roman & Associates, said the best type of security is layered and uses cross-verification, such as a Customs and Border Protection officer checking passports, fingerprinting machines and facial recognition technology.

As for the latter, he said developers claim to have solved problems found in the older facial recognition technology. These past problems included false readings caused by a shadow on the face, blinking at the wrong time or even grimacing. Algorithms were also slow at processing the data.

The new technology is supposed to be faster and more accurate. “Whether that’s true or not, time will tell,” Roman said.

Arthur is still waiting to see that facial recognition technology is as reliable as fingerprinting. He wants to know the number of false positives and if facial recognition technology is affected by haircuts, beards or glasses.

They both agree, however, that the vigilance is warranted.

“Our technology needs to keep evolving,” Roman said. “We need to keep changing what we’re doing. It makes it more difficult for the insurgents to create long-term research and development projects to overcome existing technology.” Source: Houston Chronicle

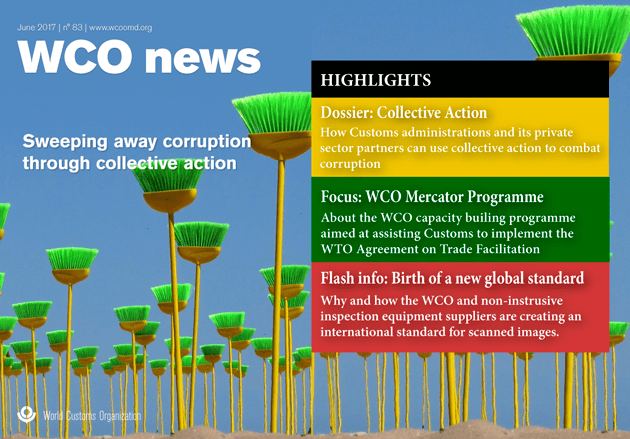

The WCO has published the 83rd edition of WCO News, the Organization’s flagship magazine aimed at the Customs community, which provides a selection of informative articles that touch the international Customs and trade landscape.

This edition features a special dossier on the use of collective action to fight corruption and how it can apply in the Customs context, and includes both country-specific experiences as well as the views of Customs’ partners.

It also puts a spotlight, in its focus section, on the WCO Mercator Programme, the capacity building programme designed by the WCO to assist governments in implementing the Customs trade facilitation measures outlined in the WTO Agreement on Trade Facilitation.

Other highlights include articles on the implementation of a new standard to ensure that men and women receive equal pay for equal work, enhanced control of light aviation in West Africa, the use of basic mathematics to fight corruption and bad practices, and much more.

The magazine is published and distributed free of charge three times a year, in February, June and October, and is available online or in paper format. Source: WCO

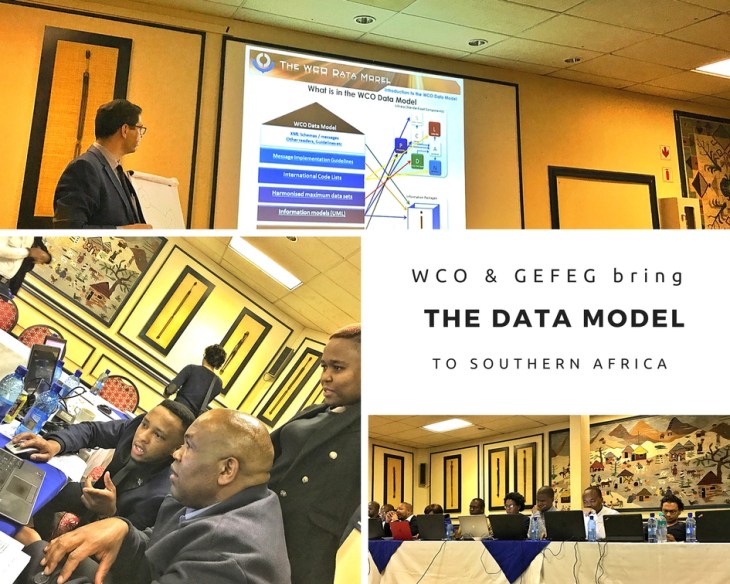

At least 30 representatives of the Southern African Customs Union (SACU) recently met in Maseru – capital of the ‘Mountain Kingdom’ – Lesotho, to undertake a 5-day training workshop on the WCO Data Model, between 29 May to 2 June.

The training formed part of capacity building support to Member States to implement IT connectivity and information exchange between SACU Customs Administration. The training was facilitated by WCO Data Model Expert, Mr Carl Wilbers from South African Revenue Service (SARS) and GEFEG.FX software tool Expert, Mr. Martin Krusch from GEFEG, Germany.

The recent ratification of Annex E to the SACU agreement – on the use of Customs-2-Customs (C-2-C) Data Exchange between member states – paves the way for participating countries to exchange data within the terms of the agreement on the basis of the GNC Utility Block, also greed to by the respective member states. It also coincides with recent work on the establishment of a SACU Unique Consignment Reference (UCR) which must be implemented by the SACU countries in all export and transit data exchanges between themselves, respectively.

Just recently, in May 2017, the heads of SACU Customs administrations were presented a prototype demonstration of data exchange between the respective systems of the South African Revenue Service and the Swaziland Revenue Authority.

The WCO Data Model provides a maximum framework of standardized and harmonized sets of data and standard electronic messages (XML and EDIFACT) to be submitted by Trade for Cross-Border Regulatory Agencies such as Customs to accomplish formalities for the arrival, departure, transit and release of goods, means of transport and persons in international cross border trade.

The course was extremely comprehensive, providing SACU customs users the full spectrum of the power and capability which the GEFEG.FX software tool brings to the WCO’s Data Model. GEFEG is also the de facto Customs data modelling and data mapping tool for several customs and border authorities worldwide. It significantly enhances what was once very tedious work and simplifies the process of mapping data, ensuring that the user maintains alignment and consistency with the most up-to-date version of WCO data model. One of the more significant capabilities of the GEFEG.FX software is its reporting and publishing capability. For examples of this please visit the CITES electronic permitting toolkit and the EU Customs Data Model webpages, respectively. Pretty awesome indeed!

Users had the opportunity of mapping the SACU agreed data fields both manually as well as using the tool. The SACU group was able to add additional enhancements to its agreed data model, providing an added benefit of the work session.

Historically, a customs officer’s “intuition” backed up by his/her knowledge and experience served as the means for effective risk management. In the old days (20 years ago and back) there wasn’t any need for all this ‘Big Data’ mumbo jumbo as the customs officer learnt his/her skill through painful, but real-life experience, often under bad and inhospitable conditions.

Today we are a lot more softer. The age of technology has superseded, rightly or wrongly, the human brain. Nonetheless, governments thrive on their big-spend technology budgets to ensure the safety of their economies and supply chains.

No less, the big multinational corporations whose ‘in-house’ business is no longer confined by national boundaries or continents are responsible for the generation of huge amounts of data which need to extend to the limits of their operations. When the products of such business are required to traverse national boundaries and continents, their logistics and transport intermediaries, financiers, and insurers become themselves tied up in the vicious cycle of data generation and transfer, also spanning national boundaries to ensure those products arrive at their intended destinations – intact, in time and fit for purpose. Hence we have what as become known as the international supply chain.

It does not end there. Besides the Customs authorities, what about the myriad of other government regulatory authorities who themselves have a plethora of forms and information requirements which must be administered and approved prior to departure and upon arrival of goods at their destination.

Inefficiencies along the supply chain culminate in delays with added cost which dictates the viability for sale and use of the product during delivery. These may constitute what is called non-tariff barriers (or NTBs) which negatively impact the suppliers credibility in international trade.

The bulk of this information is nowadays digitised in some for or other. It is obviously not all standardised and structured which makes it difficult to align, compare or assimilate. For Customs it poses a significant opportunity to tap into and utilise for verification or risk management purposes.

The term ‘Big Data’ embraces a broad category of data or datasets that, in order to be fully exploited, require advanced technologies to be used in parallel. Many big data applications have the potential to optimize organizations’ performance, (and here we have it) the optimal allocation of human or financial resources in a manner that maximizes outputs.

At this point, let me introduce one of the latest WCO research papers – “Implications of Big Data for Customs – How It Can Support Risk Management Capabilities” by Yotaro Okazaki.

The purpose of this paper is to discuss the implications of the aforementioned big data for Customs, particularly in terms of risk management. To ensure that better informed and smarter decisions are taken, some Customs administrations have already embarked on big data initiatives, leveraging the power of analytics, ensuring the quality of data (regarding cargos, shipments and conveyances), and widening the scope of data they could use for analytical purposes. This paper illustrates these initiatives based on the information shared by five Customs administrations: Canada Border Services Agency (CBSA); Customs and Excise Department, Hong Kong, China (‘Hong Kong China Customs); New Zealand Customs Service (‘New Zealand Customs’); Her Majesty’s Revenue and Customs (HMRC), the United Kingdom; and U.S. Customs and Border Protection (USCBP). Source: WCO

Dubai Customs has introduced a sophisticated scanner that can detect 25 controlled and banned items in 25 seconds, in a bid to clamp down on smuggling. “The Ionscan 500DT can also detect as little drugs or explosives as one nanogram — which is one billionth of a gram” — according to Mohammad Juma Nasser Buossaiba, Director-General of the UAE Federal Customs Authority.

The highly sensitive scanner, equipped with HD touchscreen, is one of many other advanced equipment the authority has provided the Dubai Customs with in order to tightly secure all the crossing borders of the emirate. The new devices are in line with a memorandum of understanding signed recently between the UAE Federal Customs Authority and Dubai Customs. The Federal Customs Authority will also provide training to Dubai Customs staff on how to use the new devices, apart from the regular maintenance. Source: CustomsToday.pk and WCO IRIS

The introduction in the coming months of a new customs tariff in Angola is feeding expectations among economic agents that replacing the current regime will be a stimulus to the country’s growth.

The introduction in the coming months of a new customs tariff in Angola is feeding expectations among economic agents that replacing the current regime will be a stimulus to the country’s growth.

A new customs tariff system, submitted to the Council of Ministers and expected to be implemented this year, proposes cuts on import duties on foodstuffs such as fruit and vegetables, cooking oils and grains (including wheat flour), as well as raw materials such as iron, steel and aluminium products as well as second-hand cars, the Angolan press reported.

The aim is to replace the existing customs tariff system – introduced in 2014 before the start of the economic and financial crisis now facing the country – which is generally regarded as protectionist of local farmers and manufacturers, seeking to make imports more expensive in order to encourage diversification of an economy that is highly dependent on oil.

The current tariff has been the subject of much criticism from local and international companies as well as from the World Trade Organization (WTO).

In its most recent report on Angola, the Economist Intelligence Unit (EIU) said replacing the current tariff would likely be a positive move, as it had the effect of increasing the cost of domestic production and reducing competition in the market.

Despite tariff protection, the EIU points out that operational challenges – such as a lack of electricity, poor supply chain management and lack of human resources – have kept the country dependent on imports.

In addition to this, the fall in the price of oil following the introduction of the 2014 tariff has limited access to foreign currency for Angolan companies, making payments to suppliers abroad difficult and, as the kwanza has weakened, imports have become significantly more expensive.

“If and when (the new tariff is) applied, the cost of imports should fall and this should help fight inflation. A less protectionist customs regime should also stimulate Angola’s trade with its neighbours and can help the country finally meet the long-standing promise of joining the Southern African Development Community’s free trade zone,” the EIU said.

“A review of Angola’s current punitive customs regime should give a positive boost to the national economy. However, it is still unclear when the new tariffs will be applied,” it said.

In 2016, Angola formalised its accession to the International Convention for the Simplification and Harmonization of Customs Procedures (Kyoto Convention) of the World Customs Organisation, which aims to facilitate international trade.

Each acceding country has a deadline of 36 months to apply the general rules of this agreement, which provides for the minimisation of customs controls between members, thus facilitating and simplifying international trade. Source: macauhub

The Maputo Corridor Logistics Initiative (MCLI) recently published a communication informing it’s stakeholders about the Single Road Cargo Manifest as received from the Mozambican Revenue Authority (MRA).

The Maputo Corridor Logistics Initiative (MCLI) recently published a communication informing it’s stakeholders about the Single Road Cargo Manifest as received from the Mozambican Revenue Authority (MRA).

The MRA has informed MCLI that the 2nd phase of the Single Road Cargo Manifest process will come into effect from the 16th of June 2017, when all international road carriers transporting goods to Mozambique through the Ressano Garcia border post will be required to submit the Road Cargo Manifest on the Single Electronic Window platform in compliance with national and international legislation. MRA Service Order Nr 17/AT/DGA/2017, in both Portuguese and English, is attached for your consideration.

For information and full compliance by all members of staff of this service, both (National and Foreign) International Cargo Carriers, Clearing Agents, Business Community, Intertek and other relevant stakeholders, within the framework of the ongoing measures with a view to adequate procedures related to the submission of the road cargo manifest, for goods imported through the Ressano Garcia Border Post, in strict compliance to both the national and international legislations, it is hereby announced that, the pilot process for transfer of competencies in preparation and submission of the road cargo manifest to Customs from the importer represented by his respective Clearing Agent to the Carrier is in operation since December 2016.

Indeed, the massification process will take place from 15th of April 2017 to 15th of June 2017, a period during which all international carriers (national and foreign) who use the Ressano Garcia Border, are by this means notified to register themselves for the aforementioned purposes following the procedures attached herewith to the present Service Order.

As of 16th of June 2017, the submission of the road cargo manifest into the Single Electronic Window (SEW) for the import regime, at Ressano Garcia Border, shall be compulsory and must be done by the carrier himself.

International road carriers must therefore register for a NUIT number with the Mozambican Revenue Authority between the 15th of April and the 15th of June 2017 and the necessary application form is included. Road carriers are urged to do so as soon as possible to enable the continued smooth flow of goods through the border post.

Specific details can be found here!

Source: MCLI

This initiative brings together the foremost experts in Customs matters to meet the demands of a complex international and cross-border trading system. Business professionals, Customs managers and administrators, border agency officials, international organization representatives and academia will benefit from the intensive interactive discussions of the most pertinent topics in the Customs environment today.

The courses will be led by technical experts widely respected in their various fields and will also include instructors from private sector companies, government institutions, and academia. The primary objective of the WCO Knowledge Academy for Customs and Trade is to provide an intense training for Customs and Business practitioners.

The Academy is open to all interested participants. Registration is free for one participant from each WCO Member administration. Additional participants from Member administrations, and non-WCO Member participants are subject to a fee. The Public Sector learning track will have interpretation in English and in French.

Why attend?

Visit the WCO Knowledge Academy for Customs and Trade webpage for up-coming details of itinerary and programme.

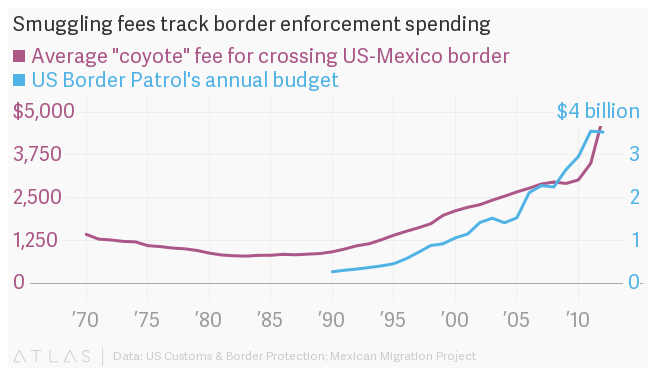

The notices detailing President Donald Trump’s promise to build a “big, attractive wall” were made public late Friday (3 April 2017) by Customs and Border Protection. The request from the Customs and Border Protection Department called for a 30-ft-high wall, but said that plans to build a wall minimum 18 ft in height may be acceptable.

“The north side of wall (i.e. USA facing side) shall be aesthetically pleasing in color, anti-climb texture, etc., to be consistent with general surrounding environment”, reads the RFP. In the documents, CBP says that the side facing the US must also be “aesthetically pleasing” in “color, anti-climb texture etc., to be consistent with general surrounding environment”.

And that’s before a new Trump budget, which came out Thursday, includes $2.6 billion over two years to begin construction of the wall. The government is asking for a 9-meter-high concrete barrier, extending 2 meters underground, built to be “physically imposing” and capable of resisting nearly any attack, “by sledgehammer, vehicle jack, pickaxe, chisel, battery-operated impact tools, battery-operated cutting tools [or] oxy/acetylene torch”.

Earlier this week Mexican lawmakers increased pressure on Mexican construction firms tempted to help build deeply reviled wall.

The proposal document asks contractors for 30-foot-long prototypes and mock-ups of 10 feet by 10 feet. Although Trump made it a centerpiece of his presidential campaign to get the Mexican government tol pay for the wall, expectations are low that the U.S.’s southern neighbor will give money while it’s being built or afterwards.

The specifications leave almost all of the design work to interested bidders, who now have about two weeks to develop and submit their plans, known as proposals. Trump called for the wall to stop illegal immigration into the United States from Mexico and to cut off drug-smuggling routes.

Senate Majority Leader Mitch McConnell (R-Ky) said in January that the wall would cost between $12 billion and $15 billion, though other estimates have put the price tag as high $25 billion.

There was some misplaced optimism that Donald Trump would immediately jettison all of his inane campaign promises upon taking office; that the threat of a wall at the Mexican border would be quietly tabled for its obvious insanity.

Proponents of a wall make two questionable assumptions: First, that there will be a continued north flow of refugees. Friday’s release did not address the overall cost of the wall. The city of Berkeley, California, said last week it would refuse to do business with any company that’s part of the border wall. The cost of about 1,000 miles of wall could cost $21.6 billion between now and 2020. Published on Aliveforfootbal website

Forget increasing the number of Free Trade Zones at and around UK ports, real thought should be given to whether Britain could become a nationwide FTZ, a panel discussion at Multimodal heard today.

The discussion, organised by the Chartered Institute of Logistics and Transport, weighed the advantages and disadvantages of setting up more FTZs as Britain’s starts its exit journey from the European Union.

While Geoff Lippitt, business development director at PD Ports, said that there was no “desperation for the traditional type of FTZ”, he conceded that as UK ports enter a new post-EU member era, any method that could improve the competitiveness of the nation’s exports should be considered.

Tony Shally, managing director of Espace Europe, added that FTZs would give the UK a great opportunity to bring manufacturing back to the country.

Bibby International Logistics’ managing director Neil Gould went a step further, calling for the creation of a ‘UK FTZ’, to facilitate a joined up environment in which it is easier to move trade. “We need to think how we work together as an industry and how we join everything up to make the UK more competitive,” he said.

However, Barbara Buczek, director of corporate development at Port of Dover, sounded a word of caution, warning that FTZs could actually be detrimental for ro-ros, an important cargo mode for the south UK port. “It’s a great concept, but we also have to be mindful of the guys on the other side who we have to ‘play’ with,” she said, adding that she is “a bit sceptical” about how an FTZ plan could pan out. Originally published by Port strategy.com

Growing electronic commerce (E-Commerce) has provided unparalleled opportunities for and has become a game changer in the international trade arena. It has revolutionized the way businesses and consumers are selling and buying goods with wider choices, advanced shipping, payment, and delivery options. At the same time, E-Commerce, in particular Business to Consumer and Consumer to Consumer (B2C and C2C) transactions, is presenting several challenges to governments and businesses alike.

Growing electronic commerce (E-Commerce) has provided unparalleled opportunities for and has become a game changer in the international trade arena. It has revolutionized the way businesses and consumers are selling and buying goods with wider choices, advanced shipping, payment, and delivery options. At the same time, E-Commerce, in particular Business to Consumer and Consumer to Consumer (B2C and C2C) transactions, is presenting several challenges to governments and businesses alike.

The WCO Working Group on E-Commerce (WGEC) together with its four Sub-Groups is steadily progressing with the four identified work packages, namely Trade Facilitation and Simplification of Procedures, Safety and Security, Revenue Collection, and Measurement and Analysis with a view to develop recommendations/guidelines on cross-border E-Commerce from a wider facilitation, security or revenue perspective, to collect and disseminate good practices/initiatives, and to enhance/update related WCO instruments and tools.

Given the current focus of the WCO Members and the private sector on this topic, the 215th/216th Sessions of the Permanent Technical Committee (PTC) held a whole day dedicated session on E-Commerce on 5 April 2017. During the ‘E-Commerce Day’, the delegates were provided an update with the work done thus far, as well as, the envisaged work by the four Sub-Groups on respective work packages. A number of valuable suggestions were provided by delegates from policy, business process, and operational perspectives to further enhance the WCO E-Commerce Work Programme with tangible and practical deliverables for providing a concerted and effective response to this growing channel of trade.

In addition, four thematic workshops relating to different dimensions of E-Commerce were organized by the Sub-Groups’ Co-Leads together with other partners. Through these workshops, some interesting facets of e-commerce were explored in detail and a number of interim recommendations were made concerning facilitation, risk management, safety and security, revenue collection, and associated capacity building through enhancement partnerships with all e-commerce stakeholders and augmented public awareness and outreach programmes.

In the course of the panel sessions, a number of collaboration success stories were identified, and they will be captured more formally and shared with interested parties, through the WCO webcorner.

The WGEC Sub-Groups will continue carrying out further work and a consolidated set of interim recommendations will be presented to the July 2017 Sessions of the WCO Policy Commission and Council. Source: WCO

The South African Revenue Service (SARS) has seized a Ferrari that was smuggled into the country. The luxury vehicle worth an estimated R13.8m was stored at a warehouse in South Africa since 2014.

In February 2015, however, the vehicle’s owner submitted an export declaration to take the car to the Democratic Republic of Congo through Beitbridge border post. A day later, there was an attempt to have the vehicle returned to South Africa through the same border post.

The vehicle has been detained and a letter of intent has been issued to the owner in terms of the Promotion of Administrative Justice Act No 3 of 2000 to enable them to make representation to SARS.

The recent WCO publication of a Study Report on E-Commerce is based on a short survey answered by the Organization’s Members. The Report compiles Customs administrations’ practices as well as their ongoing and/or future initiatives related to the processing of cross-border low-value e-commerce.

The recent WCO publication of a Study Report on E-Commerce is based on a short survey answered by the Organization’s Members. The Report compiles Customs administrations’ practices as well as their ongoing and/or future initiatives related to the processing of cross-border low-value e-commerce.

Current practices, issues and challenges as well as initiatives and potential solutions are presented in each of the survey sections: Facilitation; Risk Management; Data Exchange/Cooperation with E-Commerce Operators; Control and Enforcement; Revenue Collection. Case studies are also widely used throughout the document to illustrate specific practices.

The survey was undertaken as part of the WCO Work Plan on Cross-Border E-Commerce aimed at addressing cross-cutting issues in relation to e-commerce and coming up with practical solutions for the facilitated clearance of low-value shipments, including appropriate duty/tax collection mechanisms and control procedures.

An overview of the WCO’s work so far, including tools, reports and interim recommendations issued by the WCO Working Group on E-Commerce (WGEC), as well as work to be completed in the future, is available here. Source: WCO

You must be logged in to post a comment.