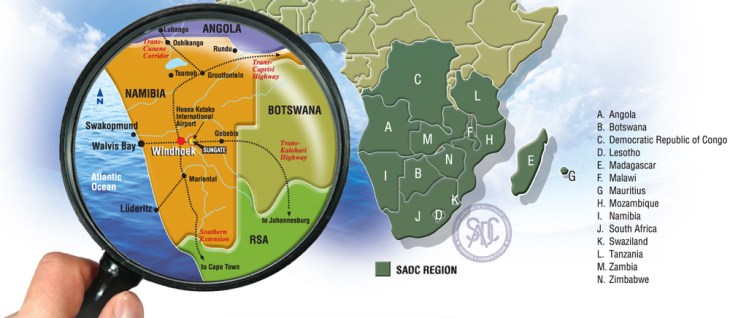

Below is a situation which might have been avoided if trader registration/licensing was properly addressed by the Namibian Authorities. With the likes of SADC and COMESA encouraging the implementation of regional transit guarantees, trade operators need to clearly address their obligations and liabilities. Moreover, any suggestion of authorised economic operator (AEO) programme in the Southern African region needs to fully align its requirements with the standards being applied by other countries across the globe. It is therefore clear that no preferred trader scheme can be implemented across the Trans-Kalahari Corridor or across SACU if such disparities of knowledge and practice exist. While one might have compassion for possible job redundancies and the pleas expressed by certain clearing agents, they evidently do not understand the game they are playing in and will drastically need to redress their understanding of the role they play in the supply chain. International clearing and forwarding is not a game for sissies, or people who want to try their hand at a quick buck. A bold stance by the Ministry of Finance.

Below is a situation which might have been avoided if trader registration/licensing was properly addressed by the Namibian Authorities. With the likes of SADC and COMESA encouraging the implementation of regional transit guarantees, trade operators need to clearly address their obligations and liabilities. Moreover, any suggestion of authorised economic operator (AEO) programme in the Southern African region needs to fully align its requirements with the standards being applied by other countries across the globe. It is therefore clear that no preferred trader scheme can be implemented across the Trans-Kalahari Corridor or across SACU if such disparities of knowledge and practice exist. While one might have compassion for possible job redundancies and the pleas expressed by certain clearing agents, they evidently do not understand the game they are playing in and will drastically need to redress their understanding of the role they play in the supply chain. International clearing and forwarding is not a game for sissies, or people who want to try their hand at a quick buck. A bold stance by the Ministry of Finance.

The Namibian Ministry of Finance’s decision to ban clearing agents from using guarantees and bonds from third parties as security to move goods has caused an uproar among clearing agents. The Deputy Minister of Finance, Calle Schlettwein, explained that the decision that became effective on July 26 was taken to protect the taxpayer. Clearing agents aren’t closed down, and neither are they stopped from using their own security to move these goods, he said. As from July 26, the agents are simply not allowed to use a bond or guarantee issued to another clearing agent as security for their goods in transit, the ministry said.

Before the clampdown, clearing agent A used to ‘borrow’ guarantees or bonds, backed by financial or other institutions from clearing agent B to clear any goods coming through Namport and destined for landlocked countries such as Botswana, Zambia and Zimbabwe. However, should a problem develop with agent A’s consignment, the guarantee or bond would be worthless to Government, as the financial institution agreed to back only agent B’s guarantee or bond. “We don’t know how or when the practice started, but it is illegal,” a ministry spokesperson said.,

Schlettwein said Government stood to lose out on duties and customs through the practice, and the taxpayers would have ended up having to pick up the tab. The ministry’s announcement was met with considerable protest from the smaller clearing agencies, claiming that they didn’t have the money or financial backing to secure the necessary bonds or guarantees. Nampa reported that 76 small and medium enterprises (SMEs) operating as clearing agencies at the coast have been affected. At the Oshikango border post and at Helao Nafidi in the North, 30 agencies with more than 100 employees are affected.

Regina Amupolo of Pride Clearing and Forwarding Agent has called on the ministry to urgently look into this matter, because many trucks with goods and containers are stuck at the Oshikango border post, Walvis Bay harbour or at other border posts. Their customers have already complained that they are losing business because of this, Amupolo said. Amupolo said most SMEs don’t have the money to obtain bonds or guarantees. She said ministry officials said anyone who wants a bond must have collateral of N$1,6 million. “We are small business people, trying to employ ourselves and some of our fellow men and women in our societies, but now the Government, the Ministry of Finance, is making things difficult for us. How are we going to make a living if the ministry is cutting off our jobs in this way?” she asked.

In a letter written to all clearing agents at Oshikango, the controller customs and excise officer, Festus Shidute, said the practice of using third-party bonds or guarantees posed a serious challenge to customs administration and control of guarantees in the event of liabilities by third parties. Amupolo and Rejoice Nangolo from Flora Clearing Agent said they have already paid N$20 000 to obtain a clearing licence, while they have to pay Namport another N$20 000. She said they are losing thousands of dollars as a result of this unexpected prohibition by the ministry and are demanding an extension to allow them to take the matter up with the ministry.

Nangolo said her business has branches at other border posts like Omahenene, Katwitwi, Ngoma, Wenela, Trans-Kalahari, Ariamsvlei, Noordoewer, Walvis Bay, Hosea Kutako International Airport and Oshikango. Her Angolan customers have threatened to stop moving their goods through Namibia and only to use their own ports, she said. At Oshikango there are only two big companies, Piramund and CRN, that can guarantee bonds and assist them as SMEs clearing their work effectively. According to Amupolo and Nangolo, they started with their clearing business in Oshikango in 2000 and were doing well until the ministry imposed the ban.

Speaking to Nampa, Lunomukumo Taanyanda of Oluvanda Clearing and Forwarding Close Corporation (OCFCC) said his company has been operational for two years and deals mostly with car consignments from countries such as the United Kingdom (UK) and Dubai.Before clearing the consignments, OCFCC has to declare the consignment at the Namport customs desk. However, before they can fill in a customs declaration form to clear the transit goods, the goods need to be secured and this is where the company (OCFCC) requires the assistance of third parties such as Wesbank Transport, Transworld Cargo and Woker Freight Services.

These smaller companies acquire assistance from bigger companies (the third parties) as they experience problems when trying to obtain their own bonds and guarantees. According to Taanyanda, it is a very costly and time-consuming process. “We agents do not have enough collateral for bonds, which start at N$350 000, and now the ministry has stopped us from borrowing bonds from third parties,” he said. Source: The Namibian

Related Articles

http://www.namibian.com.na/news/marketplace/full-story/archive/2012/august/article/clearing-agents-want-answers-today/

As Customs and Border regulatory authorities ramp up their commitment to international agreements, such as the WCO Revised Kyoto Convention, SAFE Framework of Standards and the more recent WTO Trade Facilitation Agreement, more countries will offer a single point of entry through which traders, international carriers and logistics providers can access and comply with the resident customs and other government regulatory regimes.

As Customs and Border regulatory authorities ramp up their commitment to international agreements, such as the WCO Revised Kyoto Convention, SAFE Framework of Standards and the more recent WTO Trade Facilitation Agreement, more countries will offer a single point of entry through which traders, international carriers and logistics providers can access and comply with the resident customs and other government regulatory regimes. French shipping giant CMA CGM will start phasing in ‘smart’ containers this year, allowing the line and its customers to keep track of each box equipped with new sensors at all times. In an industry first, technology being developed with a start-up company, Traxens, would enable data on the location and condition of the container to be monitored at all times throughout a delivery.

French shipping giant CMA CGM will start phasing in ‘smart’ containers this year, allowing the line and its customers to keep track of each box equipped with new sensors at all times. In an industry first, technology being developed with a start-up company, Traxens, would enable data on the location and condition of the container to be monitored at all times throughout a delivery. The Kenya Trade Network Agency, operator of the National Electronic Single Window System, has refuted claims by some clearing agents that the platform is lapsing.

The Kenya Trade Network Agency, operator of the National Electronic Single Window System, has refuted claims by some clearing agents that the platform is lapsing.  Since July 2014, EAC revenue officers work together to facilitate trade within the community. Some improvements remain made; the Single Customs Territory (SCT) does present some advantages. Since the single customs territory is operational, clearing processes are established in the country of destination while the goods are still at the port of Dar es Salaam”, explains Leah Skauki, a SCT liaison officer at the Tanzania Revenue Authority (TRA).

Since July 2014, EAC revenue officers work together to facilitate trade within the community. Some improvements remain made; the Single Customs Territory (SCT) does present some advantages. Since the single customs territory is operational, clearing processes are established in the country of destination while the goods are still at the port of Dar es Salaam”, explains Leah Skauki, a SCT liaison officer at the Tanzania Revenue Authority (TRA).

You must be logged in to post a comment.