US customs officials seized a container ship financed by JPMorgan this week after authorities found nearly 18 tons of cocaine with an estimated street value of $1.3 billion in the vessel.

The drug bust on the Liberian-flagged MSC Gayane is surprising for several reasons. The sheer quantity of cocaine it was carrying, its links to JPMorgan, its presence in the US, and the recent string of West African drug busts are worth noting.

A container ship financed by JPMorgan was seized by US customs officials this week after authorities found nearly 18 tons of cocaine with an estimated street value of $1.3 billion on the vessel. The drug bust on the MSC Gayane is surprising for several reasons, outlined below.

The roughly 39,500 pounds, or 17.9 metric tons, of cocaine – about the same weight as three African bull elephants – found aboard the MSC Gayane outweighed the total amount of cocaine that passed through West Africa in 2013 and all of the cocaine seized across Africa from 2013 to 2016, according to the United Nations Office on Drugs and Crime.

The vast quantity may reflect a supply glut. Global cocaine manufacturing surged by a quarter in 2016 to 1,410 tons, according to the World Drug Report 2018. The production boom is centered in Colombia, where cultivation of the coca plant rose 17% to 171,000 hectares in 2017, according to the UN.

The link between the MSC Gayane and JPMorgan may be the most surprising aspect of the drug bust.

The MSC Gayane is operated by the Switzerland-based Mediterranean Shipping Co., but JPMorgan helped finance MSC’s purchase of the ship. The two reportedly structured the purchase so the ship was owned by client assets in a transportation strategy fund run for JPMorgan’s asset-management arm.

JPMorgan hasn’t yet publicly addressed its association with the vessel, and it has declined to comment to Markets Insider.

The MSC Gayane sailed under the flag of Liberia, a West African country. West Africa is a popular transit route for smugglers between South America and Europe because of its porous borders, weak rule of law, largely unmonitored coastline, and limited infrastructure and resources. The proportion of cocaine seizures in Africa accounted for by West Africa rose to 78% in 2016, “reflecting the rapidly growing importance of West Africa as a transit area,” the UN Office on Drugs and Crime said.

But there appears to be little drug smuggling between West Africa and the US, making the MSC Gayane drug bust highly unusual. Higher street prices and a lower risk of getting caught make Europe a more lucrative and attractive market than the US, the Nigerian drug smuggler Chigbo Umeh told The Guardian in 2015.

While notable, the ship’s flag doesn’t necessarily implicate Liberia.

“A Liberian registered ship is not in itself a link with the West Africa drug economy,” Mark Shaw, the director of the Global Initiative against Transnational Organized Crime, said in an interview with Markets Insider. “Liberia serves as a flag state for much shipping.”

The drug bust on a Liberian-flagged vessel is the latest in a string of major seizures linked to West African countries this year.

In May 2018, Algerian officials seized more than 1,500 pounds of cocaine on a Liberian-registered container ship that was transporting frozen meat from Brazil, according to the BBC. In February of this year, Cape Verde officials found 21,000 pounds of cocaine, with a street value north of $700 million, on a Panamanian-flagged vessel. A month later, authorities in Guinea-Bissau notched their biggest-ever cocaine bust – and the country’s first in a decade – when they discovered more than 1,700 pounds of the drug hidden in a false bottom of a truck loaded with fish.

“There were doubts whether West Africa was still being used as a major transit route, but these seizures seem to suggest that there is a return,” Shaw said in an interview with Bloomberg in March. “It’s a surprise and it’s very significant.”

Source: The article was written by Theron Mohamed, Market Insider, 11 July 2019

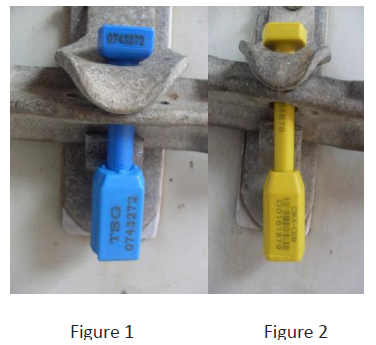

The Indian Customs department (CBEC) has allowed self-sealing procedure as of 1 October for containers to be exported, as it aims to move towards a ‘trust based compliance environment’ and trade facilitation for exporters.

The Indian Customs department (CBEC) has allowed self-sealing procedure as of 1 October for containers to be exported, as it aims to move towards a ‘trust based compliance environment’ and trade facilitation for exporters.

The year 2015 has been the most active one ever for this joint WCO – UNODC initiative, which tackles illicit trade in containerized transport.

The year 2015 has been the most active one ever for this joint WCO – UNODC initiative, which tackles illicit trade in containerized transport. The US Coast Guard has told American shippers that it will not delay implementation of the SOLAS Chapter VI amendment requiring containers to have a verified gross mass before they can be shipped.

The US Coast Guard has told American shippers that it will not delay implementation of the SOLAS Chapter VI amendment requiring containers to have a verified gross mass before they can be shipped.

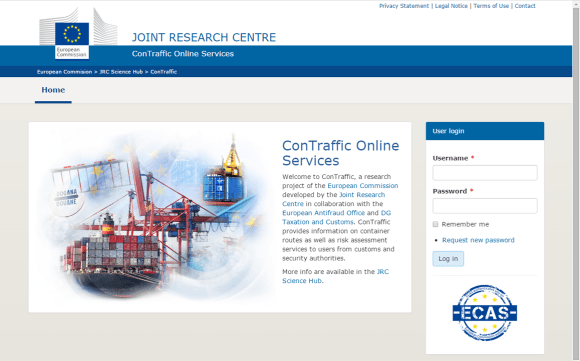

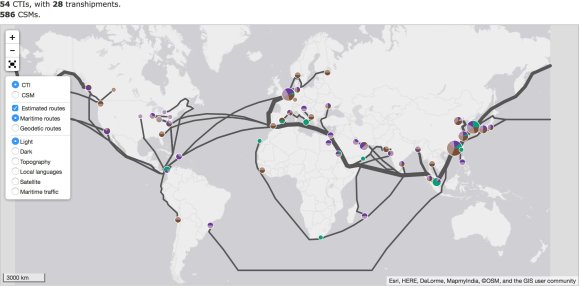

In collaboration with the European Anti-Fraud Office (OLAF), the JRC has worked extensively on how to exploit CSM data for customs anti-fraud purposes. The JRC proposed techniques, developed the necessary technology, and ran long-term experiments involving hundreds of EU customs officers to validate the usefulness of using CSM data. The results of this research led the Commission to bring forward a legislative proposal that would enable Member States and OLAF to systematically use CSM data for these anti-fraud purposes. It also served to convince Member States of the value of the proposed provisions.

In collaboration with the European Anti-Fraud Office (OLAF), the JRC has worked extensively on how to exploit CSM data for customs anti-fraud purposes. The JRC proposed techniques, developed the necessary technology, and ran long-term experiments involving hundreds of EU customs officers to validate the usefulness of using CSM data. The results of this research led the Commission to bring forward a legislative proposal that would enable Member States and OLAF to systematically use CSM data for these anti-fraud purposes. It also served to convince Member States of the value of the proposed provisions. The technologies, know-how and experience in handling CSM data, developed by the JRC through its experimental

The technologies, know-how and experience in handling CSM data, developed by the JRC through its experimental  The responsibility for verifying the gross weight of loaded containers under next year’s new box-weighing rules will in many cases rest with freight forwarders, logistics operators or NVOCCs, according to freight transport insurance specialist TT Club.

The responsibility for verifying the gross weight of loaded containers under next year’s new box-weighing rules will in many cases rest with freight forwarders, logistics operators or NVOCCs, according to freight transport insurance specialist TT Club. The following article suggests the need for greater consultation and collaboration between all supply chain parties. While the associated costs relating to supply chain movements is not the purview of SARS, these should be considered as part of the overall impact assessment in the lead up to such an implementation. For all intents and purposes this is an unintended consequence. Stakeholders should also note that the SA government has not imposed any fee for the scanning of cargoes to re-coup costs. Non-intrusive inspection (NII) capability is a tenet of international customs control intended to mitigate security threats and incidents of cargo misdeclaration, even legitimate cargo that can be used to mask harmful products stowed in vehicles/containers. The issue of increased cost of compliance has unfortunately been a trait of many international customs developments ever since the advent of ‘heightened security’ – post 9/11 and seems destined to remain a ‘challenge’ as we supposedly move into an era of increased trade facilitation.Joint collaboration between all parties not only assists in better understanding of the broader supply chain landscape but can also contribute to positive measures on the ‘ease of doing business’.

The following article suggests the need for greater consultation and collaboration between all supply chain parties. While the associated costs relating to supply chain movements is not the purview of SARS, these should be considered as part of the overall impact assessment in the lead up to such an implementation. For all intents and purposes this is an unintended consequence. Stakeholders should also note that the SA government has not imposed any fee for the scanning of cargoes to re-coup costs. Non-intrusive inspection (NII) capability is a tenet of international customs control intended to mitigate security threats and incidents of cargo misdeclaration, even legitimate cargo that can be used to mask harmful products stowed in vehicles/containers. The issue of increased cost of compliance has unfortunately been a trait of many international customs developments ever since the advent of ‘heightened security’ – post 9/11 and seems destined to remain a ‘challenge’ as we supposedly move into an era of increased trade facilitation.Joint collaboration between all parties not only assists in better understanding of the broader supply chain landscape but can also contribute to positive measures on the ‘ease of doing business’.

French shipping giant CMA CGM will start phasing in ‘smart’ containers this year, allowing the line and its customers to keep track of each box equipped with new sensors at all times. In an industry first, technology being developed with a start-up company, Traxens, would enable data on the location and condition of the container to be monitored at all times throughout a delivery.

French shipping giant CMA CGM will start phasing in ‘smart’ containers this year, allowing the line and its customers to keep track of each box equipped with new sensors at all times. In an industry first, technology being developed with a start-up company, Traxens, would enable data on the location and condition of the container to be monitored at all times throughout a delivery. In a bid to tackle overweight containers at its ports, Vietnam is seeking to address this issue with domestic legislation on container weighing practices. This is in contrast to the International Maritime Organisation, which had agreed on an amended rule that would see shipping containers being weighed before they are loaded onto ships – a rule which will come into effect in 2016.

In a bid to tackle overweight containers at its ports, Vietnam is seeking to address this issue with domestic legislation on container weighing practices. This is in contrast to the International Maritime Organisation, which had agreed on an amended rule that would see shipping containers being weighed before they are loaded onto ships – a rule which will come into effect in 2016.

You must be logged in to post a comment.