THREE regional economic communities (Recs) have taken the lead as Africa seeks to remove trade barriers by 2017. The establishment of a Continental Free Trade Area (CFTA) was endorsed by African Union leaders at a summit in January to boost intra-Africa trade. Sadc, Common Market for Eastern and Southern Africa (Comesa) and the East African Community (EAC) have combined forces to establish a tripartite FTA by 2014.

THREE regional economic communities (Recs) have taken the lead as Africa seeks to remove trade barriers by 2017. The establishment of a Continental Free Trade Area (CFTA) was endorsed by African Union leaders at a summit in January to boost intra-Africa trade. Sadc, Common Market for Eastern and Southern Africa (Comesa) and the East African Community (EAC) have combined forces to establish a tripartite FTA by 2014.

Willie Shumba, a senior programmes officer at Sadc, told participants attending the second Africa Trade Forum in Ethiopia last week that the tripartite FTA would address the issue of overlapping membership, which had made it a challenge to implement instruments such as a common currency. “…overlapping membership was becoming a challenge in the implementation of instruments, for example, common currency. The TFTA is meant to reduce the challenges,” he said.

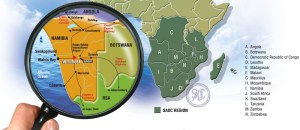

Countries such as Zimbabwe, Tanzania and Kenya have memberships in two regional economic communities, a situation that analysts say would affect the integration agenda in terms of negotiations and policy co-ordination. The TFTA has 26 members made up of Sadc (15), Comesa (19) and EAC (5). The triumvirate contributes over 50% to the continent’s US$1 trillion Gross Domestic Product and more than half of Africa’s population. The TFTA focuses on the removal of tariffs and non-tariff barriers such as border delays, and seeks to liberalise trade in services and facilitation of trade and investment.

It would also facilitate movement of business people, as well as develop and implement joint infrastructure programmes. There are fears the continental FTAs would open up the economies of small countries and in the end, the removal of customs duty would negatively affect smaller economies’ revenue generating measures.

Zimbabwe is using a cash budgeting system and revenue from taxes, primarily to sustain the budget in the absence of budgetary support from co-operating partners. Finance minister Tendai Biti recently slashed the budget to US$3,6 billion from US$4 billion saying the revenue from diamonds had been underperforming, among other factors.

Experts said a fund should be set up to “compensate” economies that suffer from the FTA. Shumba said the Comesa-Sadc-EAC FTA would create a single market of over 500 million people, more than half of the continent’s estimated total population. He said new markets, suppliers and welfare gains would be created as a result of competition. Tariffs and barriers in the form of delays have been blamed for dragging down intra-African trade.

Stephen Karingi, director at UN Economic Commission for Africa, told a trade forum last week that trade facilitation, on top on the removal of barriers, would see intra-African trade doubling. “The costs of reducing remaining tariffs are not as high; such costs have been overstated. We should focus on trade facilitation,” he said.

“If you take 11% of formal trade as base and remove the remaining tariff, there will be improvement to 15%. If you do well in trade facilitation on top of removing barriers, intra-African trade will double,” Karingi said. He said improving on trade information would save 1,8% of transaction costs. If member states were to apply an advance ruling on trade classification, trade costs would be reduced by up to 3,7%.He said improvement of co-ordination among border agencies reduces trade costs by up to 2,4%.Karingi called for the establishment of one-stop border posts.

Participants at the trade forum resolved that the implementation of the FTA be an inclusive process involving all stakeholders.They were unanimous that a cost-benefit analysis should be undertaken on the CFTA to facilitate the buy-in of member states and stakeholders for the initiative. Source: allAfrica.com

Related articles

- Regional IT inter-connectivity takes another step (mpoverello.com)

- Thick Borders – Thin Trade (mpoverello.com)

You must be logged in to post a comment.