Cahir Castle Portcullis by Kevin King

The traditional symbol of customs and borders services is the portcullis – the fortification through which a ship used to enter a port. But as developing countries are increasingly asked to recognise the benefits of liberalised trade to the detriment of their import duty revenue, how can they be helped to raise the portcullis? And is it really in their interests to do so?

With world trade growth expanding more than twice as rapidly as gross domestic product (GDP) over the past decade, says Steve Brady, director, Customs and Trade Facilitation for development consultancy Crown Agents, the potential rewards from participating in world trade are significant. “According to figures from WTO, in 2011 world merchandise exports and imports in real terms grew by over 5%. As a result, each reached over $1.8tn, the highest level in history.”

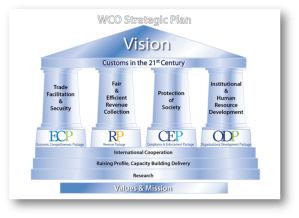

The major players working with developing country governments to help them benefit from this increase in trade include the World Bank, ICC, World Customs Organisation (WCO), IMF, UN Conference on Trade and Development (Unctad), development banks and specialist intermediaries such as Crown Agents.

A number of countries have improved their capacity as a result of international and domestic efforts, yet some are still hesitant to do so. The Centre for Customs and Excise Studies (CCES) at the University of Canberra finds that many developing country governments are heavily dependent on the revenue from import duties – in some cases this can be as high as 70% of a country’s total revenue base. The desire to protect this is understandably strong. Yet this same desire can be used to drive forward modernisation efforts, explains Professor David Widdowson, CEO of CCES. “Revenue leakage resulting from commercial fraud, poor customs and border procedures and corruption represents a major impediment to poverty reduction.”

Similarly time-consuming manual processing systems, over-regulation, or outright corruption, will discourage trade and investment and further undermine a country’s development. “In the worst cases up to 20 signatures are required to obtain customs clearance of goods, all of which require ‘informal payments’,” says Widdowson. “I have also seen examples of 15 different government agencies playing some role at the border, all acting independently.”

Guidelines or blueprints to modernise such customs and borders processes are available, for example, via the revised Kyoto convention (extolling the basic principles of automation, simplification, responsiveness to the regulation, consistency and co-ordination); the “Framework of standards to secure and facilitate global trade” developed by the WCO; and its “Columbus programme.”

Turkey is cited by Sandeep Raj Jain, economic affairs officer at the United Nations Economic and Social Commission for Asia and the Pacific (Escap), as a case study for the successful modernisation of customs systems, having consolidated 18 previously autonomous border gates and introduced a single IT clearance system, leading to an increase in tax revenues and a decrease in clearance time to the benefit of incoming and outgoing trade. Angola increased receipts sixteen-fold from $215.45m in 2000 (£148m) to $3,352m in 2011 through an improved National Customs Service and the introduction of an automated entry processing system and customs clearance Single Administrative Document.

The African Development Bank also supported post-conflict Liberia with the extension of an automated system for customs data, helping to reduce the time to clear goods at the port from 60 days to less than 10 days and increase revenue collection at three ports from about $4m a month to $10m-$12m. This, Ellen Johnson Sirleaf, president of Liberia has said, given the government additional scarce revenues to invest in the projects to improve the livelihoods of people.

Horror stories also abound of revenue loss, acting as a cautionary tale for leaving outdated customs processes untouched. A World Bank report, for example, finds that in Algeria smuggling caused a loss to the public exchequer rising from DA18bn in 2006 ($237m) to over DA61bn in 2011.

The message from the international community is that improved, automated and transparent customs services not only help eradicate theft and corruption, but also increase revenue through increased trade. Any fall in revenue from import tariffs due to signing up to bilateral free trade agreements can also be offset, says Bijal Tanna of Ernst & Young LLP: “One only has to look at the take-up of VAT by countries since the 1980s to understand that there is a consumer tax outlet to offset any loss of revenue from customs duty reductions. Back in the late 1980s, approximately 50 countries had VAT, now it is in place in over 150 countries.”

However, these arguments don’t always reach an appreciative audience. “In my experience”, says Widdowson, “economies may give lip service to the trade facilitation agenda, including entering into free trade agreements, but still expect their customs administration to collect traditional levels of duty. For example, with the introduction of free trade arrangements – hence falling duty rates – and a downturn in international trade, the Philippines continues to increase the ‘revenue targets’ of its bureau of customs, the derivation of which appears to be devoid of any analytical rigour.” (emphasis – mine)

Tanna also points to the collapse of the Doha round of the WTO negotiations heralding a breakdown in efforts to find a single global platform to drive a uniform approach to trade liberalisation. Perhaps it is the obligation of the international community to renew such efforts, alongside projects to improve customs systems in-country. Source: Original article by Tim Smedley of The Guardian

This year’s International Customs Day heralds the launch of the WCO Year of Communication, a year in which we, as a Customs community, move to further enhance our communication strategies and worldwide outreach programmes.

This year’s International Customs Day heralds the launch of the WCO Year of Communication, a year in which we, as a Customs community, move to further enhance our communication strategies and worldwide outreach programmes.

You must be logged in to post a comment.