The World Customs Organization (WCO) organized a National Workshop on Inland Depots under the sponsorship of the Customs Cooperation Fund (CCF)/Japan and the Japan International Cooperation Agency (JICA). It was held from 20 to 22 September 2016 in Savannakhet Province, Lao People’s Democratic Republic.

The World Customs Organization (WCO) organized a National Workshop on Inland Depots under the sponsorship of the Customs Cooperation Fund (CCF)/Japan and the Japan International Cooperation Agency (JICA). It was held from 20 to 22 September 2016 in Savannakhet Province, Lao People’s Democratic Republic.

Twenty six Customs officers from the Lao Customs Administration participated in the workshop, along with guest Customs experts from The Former Yugoslav Republic of Macedonia, Japan and JICA. Mr. Somphit Sengmanivong, Deputy Director General of the Lao Customs Administration, opened the workshop. He highlighted the importance of Inland Depots as a national strategy to secure his country’s economic growth and sought participants’ active participation in the discussions on this topic.

Presently, there is no clear definition of “Inland Depot” and many similar terms, such as Dry Port, Inland Terminal, Free Trade Zone and Special Economic Zones, are used in the international logistics. During the three-day workshop, participants discussed the functions and a possible definition of Inland Depot from a Customs perspective.

Comment – Inland container terminals serve as important hubs or nodes for the distribution and consolidation of imported and export destined cargoes. There are 16 Landlocked countries in Africa, which signifies the importance of hinterland logistics development and its consequential impact on regional trade groupings. Consequentially, it behooves governments to understand and support the logistics supply chain industry in maximizing inland transportation (multi-modal) infrastructures to achieve a common and mutually beneficial economic environment. Furthermore, the more facilitative these arrangements, the better opportunity there is for success and longer-term economic sustainability.

The WCO Secretariat made presentations on international standards for relevant procedures, including Customs warehouses, free zones, Customs transit, inward processing, clearance for home use and temporary admission. Experts from The Former Yugoslav Republic of Macedonia and Japan described their national and regional experience of Customs warehousing, and Customs transit procedures. The JICA expert presented the bonded procedures applied by neighbouring countries to Lao People’s Democratic Republic. Lao Customs administration explained their national system for Inland Depots and a logistics company of Lao PDR shared its expectations on inland depots.

On the last day, participants discussed the challenges and possible solutions to enhance the functional and efficiency of Lao’s Inland Depots. Possible solutions, such as the use of modern information technology, further cooperation with the private sector, clear regulations on relevant procedures, coordinated border management and international cooperation were considered. Source: WCO

Recommended reading

- The 2003 Almaty Programme of Action (UNCTAD)

- Transit – Addressing the plight of Landlocked Countries (mpoverello.com)

- A critical view in support of East African Land Locked Countries – Lessons for the South? (mpoverello.com)

- Important Implications of the WTO TFA on Landlocked Countries (mpoverello.com)

The following was penned by a long-time customs acquaintance Aires Nunes da Costa, who has kindly permitted me to post his article titled “Why unpack containers in Durban if you can have containers at your door step in Gauteng within 24 hours?” which first appeared on LinkedIN.

The following was penned by a long-time customs acquaintance Aires Nunes da Costa, who has kindly permitted me to post his article titled “Why unpack containers in Durban if you can have containers at your door step in Gauteng within 24 hours?” which first appeared on LinkedIN. The EU has signed an Economic Partnership Agreement (EPA) on 10 June 2016 with the SADC EPA Group comprising Botswana, Lesotho, Mozambique, Namibia, South Africa and Swaziland. Angola has an option to join the agreement in future.

The EU has signed an Economic Partnership Agreement (EPA) on 10 June 2016 with the SADC EPA Group comprising Botswana, Lesotho, Mozambique, Namibia, South Africa and Swaziland. Angola has an option to join the agreement in future. Here follows an appreciation of AEO within the context of the EU. According to KGH customs consultancy services, being an Authorised Economic Operator (AEO) already entails advantages for companies that have invested in doing the work to gain the AEO certification. With the new Union Customs Code (UCC), companies with an AEO permit will be able to gain additional advantages leading to more predictable and efficient logistics flows as well as an increased competitive edge.

Here follows an appreciation of AEO within the context of the EU. According to KGH customs consultancy services, being an Authorised Economic Operator (AEO) already entails advantages for companies that have invested in doing the work to gain the AEO certification. With the new Union Customs Code (UCC), companies with an AEO permit will be able to gain additional advantages leading to more predictable and efficient logistics flows as well as an increased competitive edge. The World Customs Organization (WCO), with the financial support of the Customs Administration of Saudi Arabia, successfully held a Regional Workshop on Coordinated Border Management (CBM), Single Window and the WCO Data Model in Riyadh, Saudi Arabia from 27 to 31 March 2016. Thirty seven middle management officials of the Customs Administrations from the MENA Region, namely Saudi Arabia, Egypt, Lebanon, Jordan, Morocco, Tunisia, Sudan, Bahrain and the United Arab Emirates participated in the Workshop. In addition, twelve officials of Customs’ Partner Agencies and two representatives from the private sector attended the event.

The World Customs Organization (WCO), with the financial support of the Customs Administration of Saudi Arabia, successfully held a Regional Workshop on Coordinated Border Management (CBM), Single Window and the WCO Data Model in Riyadh, Saudi Arabia from 27 to 31 March 2016. Thirty seven middle management officials of the Customs Administrations from the MENA Region, namely Saudi Arabia, Egypt, Lebanon, Jordan, Morocco, Tunisia, Sudan, Bahrain and the United Arab Emirates participated in the Workshop. In addition, twelve officials of Customs’ Partner Agencies and two representatives from the private sector attended the event. Maritime Executive reports that the world’s third largest port operator APM Terminals said it will invest 758 million euros ($858.3 million) in a new transhipment terminal in Tangier, Morocco, that will be the first automated terminal in Africa.

Maritime Executive reports that the world’s third largest port operator APM Terminals said it will invest 758 million euros ($858.3 million) in a new transhipment terminal in Tangier, Morocco, that will be the first automated terminal in Africa.

From time to time it is nice to reflect on a good news story within the local customs and logistics industry. Freight & Trade Weekly’s (2015.11.06, page 4) article – “SA will be base for development of single customs platform” provides such a basis for reflection. The article reports on the recent merger of freight industry IT service providers Compu-Clearing and Core Freight and their plans to establish a robust and agile IT solution for trade on the African sub-continent.

From time to time it is nice to reflect on a good news story within the local customs and logistics industry. Freight & Trade Weekly’s (2015.11.06, page 4) article – “SA will be base for development of single customs platform” provides such a basis for reflection. The article reports on the recent merger of freight industry IT service providers Compu-Clearing and Core Freight and their plans to establish a robust and agile IT solution for trade on the African sub-continent.

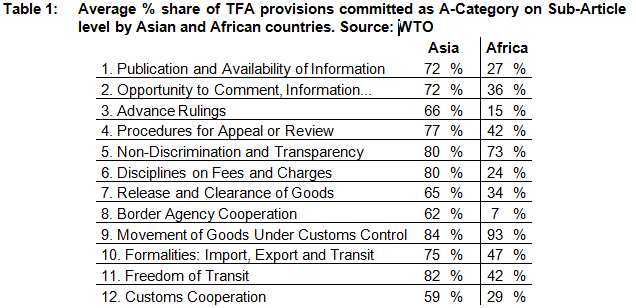

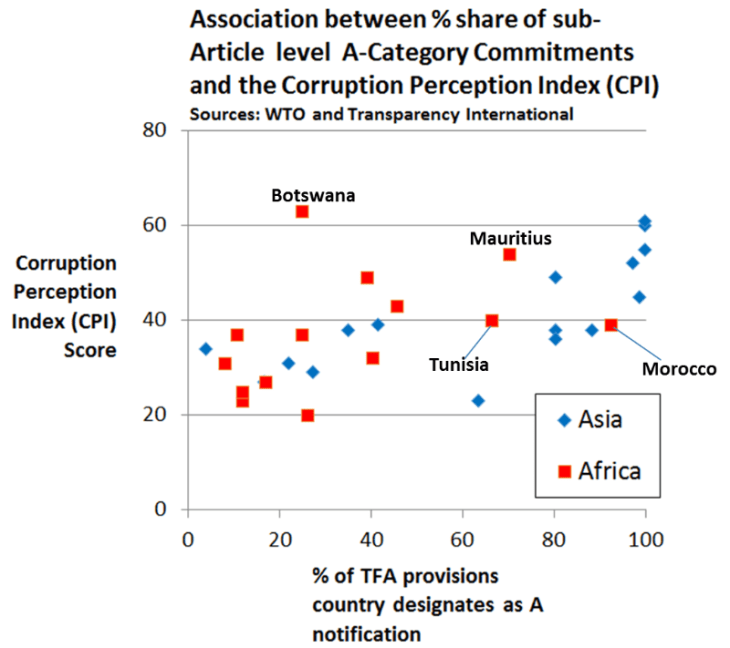

The following article is published with the kind permission of the author, Tapia Naula who is Principal Transport Economist at African Development Bank, based in the Ivory Coast. He is an international project manager and transport economist with experience in logistics business, research and trade facilitation. This article is a must for anyone associated with or working on the TFA on the African sub-continent, and a bit of a wake up call to those countries who have as yet done little or nothing to progress their participation.

The following article is published with the kind permission of the author, Tapia Naula who is Principal Transport Economist at African Development Bank, based in the Ivory Coast. He is an international project manager and transport economist with experience in logistics business, research and trade facilitation. This article is a must for anyone associated with or working on the TFA on the African sub-continent, and a bit of a wake up call to those countries who have as yet done little or nothing to progress their participation.

You must be logged in to post a comment.