The following article is published with the kind permission of the author, Tapia Naula who is Principal Transport Economist at African Development Bank, based in the Ivory Coast. He is an international project manager and transport economist with experience in logistics business, research and trade facilitation. This article is a must for anyone associated with or working on the TFA on the African sub-continent, and a bit of a wake up call to those countries who have as yet done little or nothing to progress their participation.

The following article is published with the kind permission of the author, Tapia Naula who is Principal Transport Economist at African Development Bank, based in the Ivory Coast. He is an international project manager and transport economist with experience in logistics business, research and trade facilitation. This article is a must for anyone associated with or working on the TFA on the African sub-continent, and a bit of a wake up call to those countries who have as yet done little or nothing to progress their participation.

In the World TFA Cup Asia is leading Africa 72 – 35. The first scores of the WTO Trade Facilitation Agreement are out as member countries submit their Category A notifications. Initial results of the African first series are somewhat unfulfilling. Some teams are playing defensive even if attacking tactic is the only way to win.

In December 2013, WTO members concluded negotiations on a Trade Facilitation Agreement (TFA) at the Bali Ministerial Conference, as part of a wider “Bali Package”. Among trade facilitation practitioners the Agreement was received with great enthusiasm: finally there was a legal instrument, which is concrete enough to make a difference! TFA will enter into force once two-thirds of members have completed their domestic ratification process. Section I contains substantive provisions in 12 main Articles. The members are required to categorize and notify each provision of the Agreement as either A, B or C Category. The A Category commits a country to implement the provision upon entry into force of the TFA, or one year after for LDC’s. For B-Category there will be a transitional period. C-Category provisions are allowed a transitional period, technical assistance and capacity building.

First, let it be said loud and clear: the WTO TFA is an excellent collection of modern trade and transport facilitation instruments in one folder. In developing countries its implementation would mean reforms that would save time, money and efforts for regular business people and consumers. These reforms may be painful but the countries that can do it, will be the future winners of their regional competition and they will be the ones that will most benefit from joining the global value chains. TFA is the best vehicle for poverty reduction invented so far and that is why it is so important.

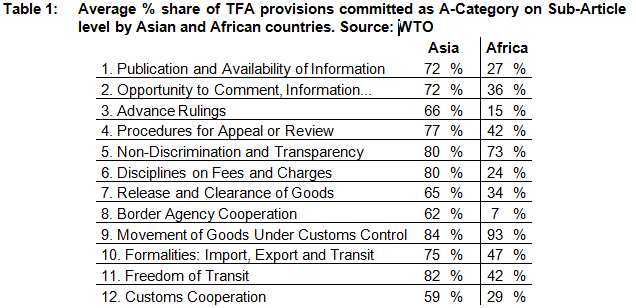

In August, 2015, 14 African countries and 25 Asian countries had submitted notifications for category A provisions. Asian countries had “accepted” 72 % of all the provisions as A-Category commitments on average where the respective share of the African countries is only 35 %. On Article-level African countries lag behind on every Article except one (Table 1).

In addition to the low overall share of category A-notifications, the African notifications generally look like “random picks” of sub-paragraphs, compared to many Asian members that have commonly chosen the strategy of basically accepting the whole Agreement and making exceptions for certain few paragraphs according to their particular needs.

Were African governments well-informed of the impact and substance of each paragraph – or are they just being cautious, perhaps trying to delay the final commitment? The patterns between African and Asian countries are in any case different.

TFA includes also “low hanging fruit” – sections that require little technical expertise to be implemented. At least some of these should have been easy for member countries to accept. “Publication and Availability of Information” is one of those sections. Access to information through internet is routine and affordable. It should not require transition periods or particular technical assistance. Donors are even competing to assist governments with such low cost and high-return activities. Still, less than one third of the African Governments notified this Article.

Here are some other peculiar findings:

- Out of 14 African countries only Morocco accepted “Border Agency Cooperation” as A –Category provision. Three of the others countries that did not notify it are landlocked countries;

- Only four out of 14 African countries had fully notified “Freedom of Transit.” Transit challenges in Africa are probably the single most significant source of inefficiency in trade logistics;

- One of the foundations of modern customs management is the introduction of Risk Management. Only 3 out of 14 African countries had notified this provision;

- Only Morocco notified Trade Facilitation Measures for Authorized Economic Operators (AEO), which gives certain privileges to traders and transport operators, who show high level of compliance to regulations. One wonders why Kenya, Uganda, Rwanda, Burundi and Tanzania did not notify it as we know that an AEO program is being piloted in the East African Community;

- Only Senegal notified the sub-Article on Single Window, which is probably the most important one of the whole Agreement. Senegal perhaps deserves this honor – being the first truly African-based single window country – and also representing the good practice of SW management. Yet, according to the African Alliance for e-Commerce, currently there are at least 16 other single windows either already operational or under development in Africa. Why weren’t these developments recognized?

Despite the above “peculiarities” the African situation is fortunately nowhere near as somber as the A-Category notifications indicate. There are plenty of trade and transport facilitation initiatives under implementation – and Africa is indeed “on the Move.” We should on one hand side make sure that the valuable TFA Agreement is not becoming a separate formal process alongside the practical actions on the ground, but rather a framework for coaching governments in climbing up the stairs toward greater competitiveness. On the other hand, the countries should not ignore the existing achievements. A lot has been achieved in Africa in recent years and this process should go on and gain speed. Some sub-regions, which have been less successful in this field need benchmarks, encouraging and coaching. This is where African and international organizations can play a role.

Although the direct cost of TFA implementation is relatively low, the indirect cost may be extremely high. The indirect cost concerns existing structures, which generate income for organizations and individuals, who often greatly benefit from the status quo. Some governments have entered into concessions outsourcing critical government functions such as pre-customs clearance operations and processing and submissions of declarations to customs. Western firms have efficiently seized the opportunity and negotiated deals, which guarantee profits for in many cases for decades to come. Single Windows in certain countries are good examples for these. In an unnamed Southern African country for example, humanitarian aid is exempt from taxes and duties in import. If however a UN agency for example imports a container of pharmaceuticals worth five million USD, it will have to pay for a Single Window fee of 42,500 USD! Such Ad Valorem fee arrangements are against the TFA. Such concessions are often built inside structures, which profit from the concessions and in exchange – protects its operations and continuity. This is why they are difficult to tackle. This is an example of the problematics that African policy makers must deal with when taking a position in committing in TFA provisions. It may be a whole lot more complicated than what it looks like.

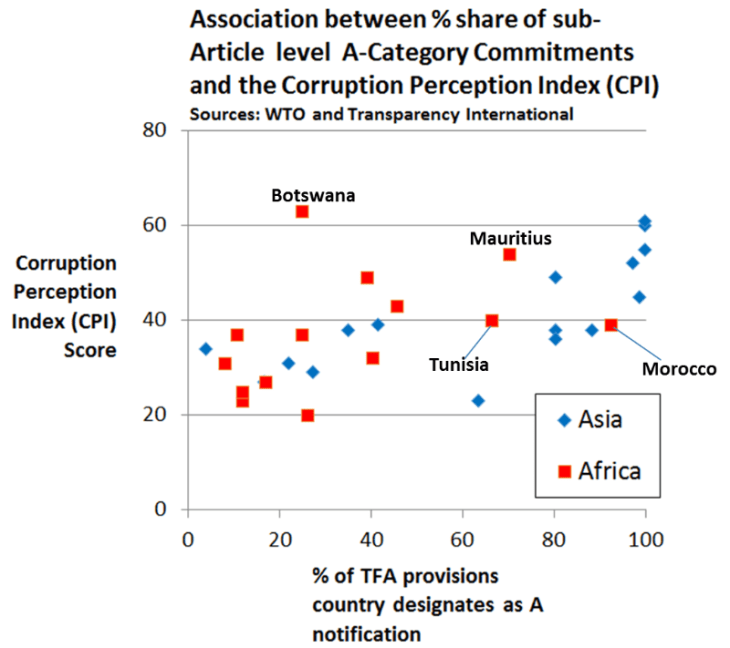

- Association between % Share of Sub-Article Level A-Category Commitments and the Corruption Perception Index Score (CPI). Sources: WTO and transparency International.

The diagram above shows the association of share of the provisions that have been covered by A-Category notifications and the Corruption Perception Index (CPI) score of the countries. For African countries the correlation is moderate (correlation co-efficient: 0.42) but for Asian countries the association is strong (correlation co-efficient: 0.73). The association of the two variables is understandable: the less corruption a country has (the higher the CPI rank is), the more reforms the government is in liberty to conduct (the higher coverage of TFA as A-category Notifications).

We need to better understand the underlying reasons why policymakers cannot let reforms take off. Traditions, corruption and outdated structures are usually the biggest obstacles. These cannot be overcome by merely providing short-term technical assistance and bench-marking the world best practices but only strong political leadership can make the change. Developing partners should raise this topic on the highest political level and “live together” through the reforms with the counterparts.

The Northern Corridor (Kenya, Uganda, Rwanda) provides an encouraging example how multiple reforms can be carried out in very short time. Only two years ago it took staggering 27 days to transport a container from Mombasa Port and deliver it in Kigali, Rwanda. Today it takes only seven days. The improvement was enabled by series of reforms, which were championed by the Heads of States of the Corridor member countries. The example proves that major improvements can indeed be achieved in very short time. On the other hand, even with the most sophisticated instruments, reforms will not succeed if there the high-level ownership is not there. Author: Tapio Naula

You must be logged in to post a comment.