Amidst diverse expectations and feelings of excitement, anxiety and anticipation, the South African Revenue Service (SARS) migrated to its new integrated Customs and Border Management solution over the weekend of 17 August 2013. A new modern electronic solution Interfront can now rightfully claim some success even if it is an unseen component within a multi-layered, multi-technology solution of which South African Customs is now the proud owner. After 9 months of rigorous parallel testing between old and new, and a period of dedicated external testing with Service Providers of the customs business community, the decision to implement was formally agreed with trade a fortnight ago.

Interfront Customs and Border Solution (iCBS) replaces several key legacy systems, one of which has served South Africa for more than 30 years. The vast business and technical competence and skills which faithfully maintained and supported the old systems are to some extent in the wilderness now, but will hopefully find place within the new technology environment. While technology nowadays is particularly agile, and human physical placement at the coal face is under threat, organisations like SARS will always require customs technical business and policy competence to maintain the cutting edge.

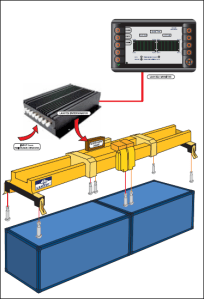

There still remains an enormous amount of work to do regarding the alignment of the new clearance system with the specific guidelines, standards and principles of the WCO. With regional integration becoming more prominent on the sub-Saharan African agenda, the matter of ‘facilitation’ and ‘non-tariff barriers’ will inevitably become more prominent discussion points. Other salient features of the SAFE Framework of Standards such as Authorised Economic Operators and IT connectivity have already emerged as key developmental goals of a number of regional customs and border authorities. The timely introduction of Interfront places SARS in a pivotal position to influence and enable the required electronic linkages, crucial for the establishment of bi-lateral and multilateral trade agreements, transport corridors, and, support for ‘seamless’ multi-modal movement of cargo from port of discharged to its place of manifestation with limited intervention, based on the principles of risk management. Enjoy the Interfront video feature.

Related articles

- A South African RFID/GPS cross-border logistics and customs solution (mpoverello.com)

You must be logged in to post a comment.