The following piece suggests that the realisation of AEO obligations on shippers is real and will be augmented by support systems that may marginalise the highly competitive freight forwarding industry. While there is a suggestion of cost savings due to non-reliance of shippers on traditional forwarding agents, I believe this is a short-sited view as the ‘real challenge’ lies in whether or not shippers are up to the task in meeting these obligations given their unfamiliarity with customs and transport requirements. I see many shippers having to recruit experienced customs and forwarding experts to maximise their compliance given the burgeoning obligations materializing in international shipping!

In October 2011, Aircargoshop an online booking portal provided shippers the possibility to book their own airfreight without involvement of the traditional shipping agent via the online portal Aircargoshop. This is a development that might have important consequences for the closed airfreight industry. As a consequence the online booking portal offers a lower-priced, more efficient and more transparent process for aircargo booking.

Founder Paul Parramore of Rhenus Logistics suggests that this system will bring down the cost of airfreight by as much as 50%. The Dutch Shipping Council EVO, gave the system the thumbs up and said that it will revolutionise the manner in which the freight business is currently being conducted.

Joost van Doesburg, a consultant with EVO said that in the long run restructuring of the industry is necessary in order to meet the challenges of the 21st century. Many of the forwarders will lose out, but the system is geared towards cost effectiveness and being competitive. He also added that if the forwarder is to add value to the supply chain, then he has to comply to adapting to the system rather than working against it.

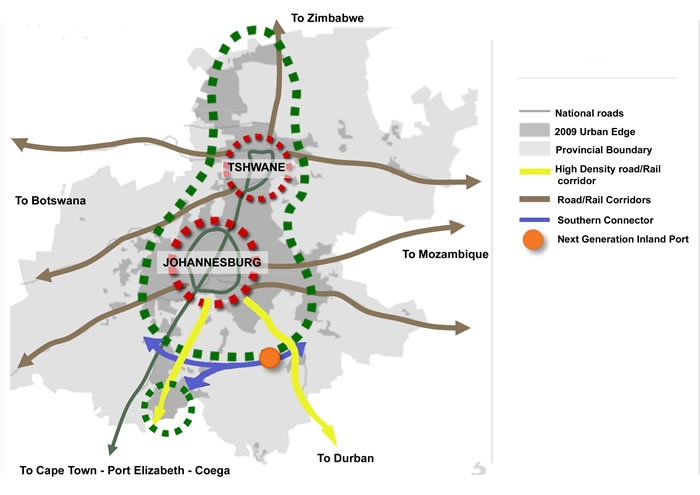

On the home front, a recent article featured on the website Freight into Africa reports that the South African Cross Border Transporters Association (SACBTA) will be introducing a similar system which is currently under development for the cross border road freight industry. It will be called “ROAFEonline” or shortened form of Road Freight online which will allow the customer to book directly his freight with accredited SACBTA members hence cutting out the middleman and brokers.

All payments can and will be done online and this system will integrate with SARS EDI (Would like to hear more on this!). The consignor will only have to ensure that his goods are loaded onto the truck, the rest will be done by the system. The cost per transaction to the customer will be a paltry R100.00 in relation to a few thousand Rands normally swallowed up by the middlemen.

Based on our estimations a regular consignor can save up to R3-5 million Rands per annum which hopefully will be passed onto the consumer. With the looming integration of the SADC countries towards one stop clearing, it makes sense to further integrate the system. So whether you are in Dar es Salaam or Lubumbashi, you can now book your freight from Cape Town without having to go through a string of brokers. You also have the assurance that your cargo will be loaded by an accredited SACBTA transporter who complies to the standards set out by SACBTA. It will facilitate consolidations as any accredited transporter will at any given time be able to see what cargo is available. If Transporter A has only 20 tons, he can check which other transporter on the system has another 8 tons to Dar es Salaam for example. The transporters can then consolidate a load on the system which will happen in a shorter period of time than say for instance waiting a month to fill a tri axle.

This system will have many other functionalities that have been incorporated like online tracking, bar coding, which will give the consignor and consignee piece of mind knowing at any given time where their cargo is. It will also be accessible to border agents and customs officials who will be in a position to extract vital information on any consignment long before it actually gets to a border.

The system will go into testing around March of this year and if all goes well should be ready for implementation by the latter part of 2012 or early 2013. We hope that this will go a long way towards restructuring the industry for the better. It has long been the desire of SACBTA to allow industry players to come on board to create a better industry. However, there has been very little interest shown in transforming the industry and we feel this system will by virtue of its nature, transform the industry whether industry players are willing participants or not. Source: Freight into Africa and various own sources.

You must be logged in to post a comment.