Container shipping lines are poised to take delivery of a new generation of “megaships” over the next two years, just as the growth of world trade is slowing down, contributing to massive overcapacity in the market.

Container shipping lines are poised to take delivery of a new generation of “megaships” over the next two years, just as the growth of world trade is slowing down, contributing to massive overcapacity in the market.

Megaships, which can be up to 400 meters long, seem to be here to stay, not least because so many more are already on order, the product of high fuel costs and low interest rates.

But the trend towards larger vessels is not without problems especially for other businesses in the transport system, and the trend could be nearing its limit as the economies of scale associated with megaships decline.

Container shipping capacity has doubled every seven years since the turn of the millennium and will reach nearly 20 million TEU in 2015 up from five million TEUs in 2000.

But since the financial crisis, container capacity has continued to grow rapidly, even as the growth in freight volumes has slowed, creating a massive overhang in shipping capacity and pressuring freight rates.

Capacity growth is being driven by the trend towards larger vessels. The size of container ships has been growing faster than for any other ship type according to the OECD’s International Transport Forum.

Between 1996 and 2015, the average carrying capacity of container ships increased 90 percent, compared with a 55 percent increase for dry bulk carriers and 21 percent for tankers.

The growth in container ship size has been accelerating. It took 30 years for the average container ship size to reach 1,500 TEU but just one decade to double from 1,500 to 3,000 TEU.

Between 2001 and 2008, the average size of newly built ships hovered around 3,400 TEU but then jumped to 5,800 TEU between 2009 and 2013, and hit 8,000 TEU in 2015.

Megaships

Both the average size of new container ships and the maximum size are set to continue growing over the next five years. Shipping lines have already taken ownership of 20 megaships with a capacity of more than 18,000 TEU each and another 52 are on order, according to the OECD.

The largest ship so far delivered has a capacity of 19,200 TEU, but carriers with capacity up to 21,100 have been ordered and will be in service by 2017.

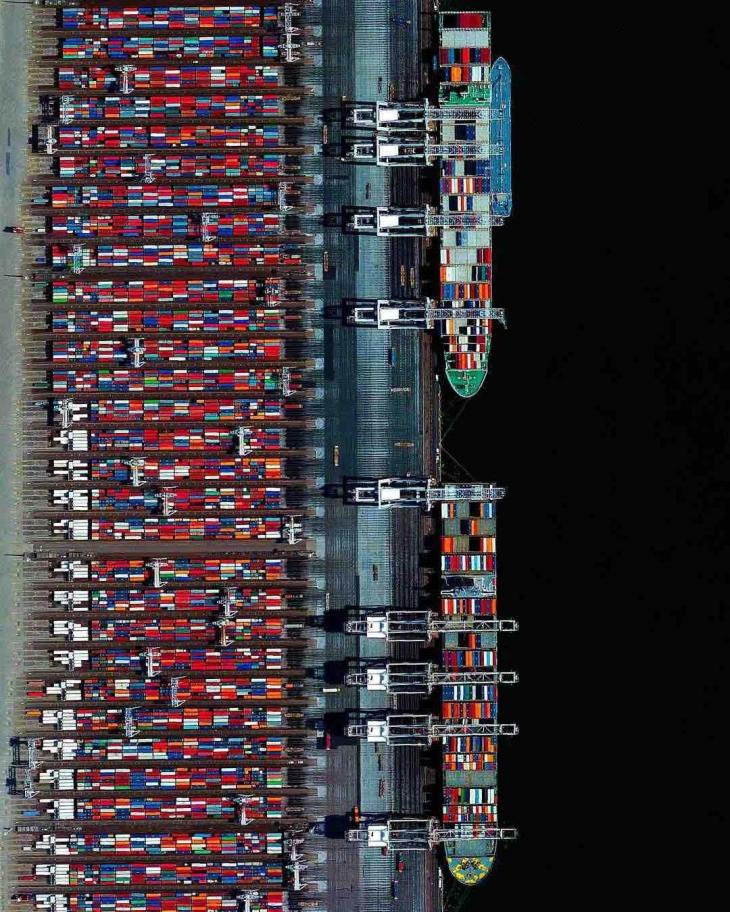

Megaships are being introduced into service between the Far East and North Europe, the world’s largest route by volume, where potential economies of scale are greatest, but are having a cascade effect on other routes.

Large ships that formerly plied the Far East-North Europe route are being displaced into Trans-Pacific service, and former Trans-Pacific carriers are moving to the Trans-Atlantic route.

The new generation of ultra-efficient megaships is credited with cutting the cost of shipping even further and lowering greenhouse gas emissions.

But researchers for the OECD question whether megaships are contributing to unsustainable overcapacity and imposing unintended costs on shippers, port operators, freight forwarders, logistics firms and insurers.

Fuel Costs

The new generation of megaships is the lagged effect of the era of high oil prices between 2004 and 2014 and low interest rates since the financial crisis in 2008.

Costs in the shipping industry can be divided into the capital costs associated with the construction of new vessels, operating costs, and voyaging costs primarily related to fuel consumption.

Construction costs increase more slowly than ship size. Increasing a container ship from 16,000 TEU to 19,000 TEU cuts the annual capital cost per TEU-slot by around $69 according to the OECD.

Larger ships are slightly more operationally efficient than smaller ones, with an annual saving of perhaps $50 per slot on a 19,000 TEU ship compared with a 16,000 TEU vessel.

But the real savings are on the fuel bills. Megaships are “astonishingly fuel efficient” and actually consume less fuel on a voyage than 16,000 TEU carriers, according to the OECD.

With overwhelming cost advantages, especially on fuel, and cheap finance readily available, the upsizing decision appears to have been a straightforward one for shipping lines.

Slow Steaming

The new generation of megacarriers has been optimized to save fuel by voyaging much more slowly than previous container vessels.

Fuel consumption is related to the cube of speed. If a vessel travels twice as fast it will consume eight times as much fuel. The cube-rule has important implications for the economics of the shipping industry.

When fuel prices are high, it makes sense to voyage slowly to cut fuel bills, even if it means operating more ships to move the same amount of cargo. When fuel prices are low, it makes sense to travel faster and use fewer ships.

During the period of soaring oil prices, container lines instructed captains to cut speed in order to conserve fuel.

The new ships ordered were specifically designed to operate most efficiently at slower speeds to take advantage of slow steaming economies. In fact some carriers are so large they cannot operate at higher speeds.

Crucially, slow steaming has now been designed into the new generation of vessels entering container service, so it will not be easily reversed, even though fuel prices have plunged since 2014.

According to the OECD, most of the voyaging cost reductions in the new generation of megaships come from their optimization for slow steaming rather than from increased size.

“Between 55 and 63 percent (at least) of the savings per TEU when upgrading the vessel size from an early 15,000 TEU design to a modern 19,000 TEU design are actually attributable to the layout for lower operation speeds,” the OECD estimated.

“Cost savings are decreasing as ships become bigger,” the OECD concluded. “A large share of the cost savings was achieved by ship upsizing to 5,000 TEU, which more than halved the unit costs per TEU, but the cost savings beyond that capacity are much smaller.”

Unintended Costs

The consolidation of container volumes into fewer, larger megaships is creating challenges for other firms in the freight business.

Insurers are worried about the costs if a megaship sinks or develops mechanical problems. Insurer Allianz has warned the industry must prepare for losses of more than $1 billion, or even up to $2 billion in the event of a collision between two megaships.

Economies of scale depend on megacarriers being loaded close to maximum capacity and spending as much time as possible at sea rather than in port.

The need to fill megaships is one reason that the industry is consolidating into an alliance network.

Shipping lines are also adopting the hub-and-spoke system employed by airlines to ensure their ultra-large container vessels sail nearly full.

Shipping schedules for the megacarriers have been consolidated into fewer sailings each week from fewer ports (about six in North Europe and eight in Asia).

Containers for other destinations must be transhipped, either on a smaller container vessel or by road, rail and barge. Schedule consolidation is not necessarily favored by shippers and freight forwarders who prefer regular and reliable service (fewer sailings can mean more concentrated risk).

Port operators, too, have been forced to invest heavily to attract and handle the new megacarriers. Port channels must be dredged to greater depths to handle the deeper drafts of the megaships. Quaysides must be raised and strengthened to handle the increased forces when a megaship is tied up.

The biggest problem comes from the scramble to unload a megacarrier quickly so it can put to sea again. The average turnaround time for a container ship is now just one day, and less in Asia.

The arrival of fewer vessels but with larger numbers of containers is creating intense peak time pressure on the ports.

Ports need more cranes, more highly skilled staff to operate them fast, more space in the yard, and the ability to handle more trucks, railcars and barges to move the containers inland.

The OECD estimates megaships are increasing landside costs by up to $400 million per year (one third for extra equipment, one third for dredging, and one third for port infrastructure and hinterland costs). Source: Maritime Executive/Reuters.

Market forces, competition and the desire to be ahead of the competition demonstrate how dynamic the international supply chain is being maneuvered. Amazon’s latest move is not only innovative but demonstrates just how adaptable international trade and Customs Inc. need to be in order to accommodate nuances to traditional accepted norms in global trade. For Customs, it needs to intimately understand the nature of business of its registered or licensed traders so as to properly apply risk and facilitation regimes appropriately. Recent developments in mutual recognition likewise play an important role in awarding real benefits to companies and their supply chains who undertake such global innovations.

Market forces, competition and the desire to be ahead of the competition demonstrate how dynamic the international supply chain is being maneuvered. Amazon’s latest move is not only innovative but demonstrates just how adaptable international trade and Customs Inc. need to be in order to accommodate nuances to traditional accepted norms in global trade. For Customs, it needs to intimately understand the nature of business of its registered or licensed traders so as to properly apply risk and facilitation regimes appropriately. Recent developments in mutual recognition likewise play an important role in awarding real benefits to companies and their supply chains who undertake such global innovations. Paper bills of lading have been used throughout the world to document and effect international trade for centuries. Yet whilst the world has become increasingly digitalised the paper bill of lading has, on the whole, remained a constant feature of global trade. Its continued use is mainly due to its combination of three legal characteristics that it has developed over time: (i) it is a receipt of the goods carried; (ii) it provides evidence of the terms of the contract of carriage; and (iii) it is a document of title to the goods. It is these characteristics that have, until relatively recently, foiled attempts to replace the paper bill of lading with an electronic equivalent. However, with the inclusion of an electronic bills of lading clause in BIMCO’s NYPE 2015 time charter form, as well as the International Group of P&I Clubs’ approval of the coverage of three electronic trading systems, the dominance of the paper bill of lading may well be coming to an end.

Paper bills of lading have been used throughout the world to document and effect international trade for centuries. Yet whilst the world has become increasingly digitalised the paper bill of lading has, on the whole, remained a constant feature of global trade. Its continued use is mainly due to its combination of three legal characteristics that it has developed over time: (i) it is a receipt of the goods carried; (ii) it provides evidence of the terms of the contract of carriage; and (iii) it is a document of title to the goods. It is these characteristics that have, until relatively recently, foiled attempts to replace the paper bill of lading with an electronic equivalent. However, with the inclusion of an electronic bills of lading clause in BIMCO’s NYPE 2015 time charter form, as well as the International Group of P&I Clubs’ approval of the coverage of three electronic trading systems, the dominance of the paper bill of lading may well be coming to an end. The new

The new

From time to time it is nice to reflect on a good news story within the local customs and logistics industry. Freight & Trade Weekly’s (2015.11.06, page 4) article – “SA will be base for development of single customs platform” provides such a basis for reflection. The article reports on the recent merger of freight industry IT service providers Compu-Clearing and Core Freight and their plans to establish a robust and agile IT solution for trade on the African sub-continent.

From time to time it is nice to reflect on a good news story within the local customs and logistics industry. Freight & Trade Weekly’s (2015.11.06, page 4) article – “SA will be base for development of single customs platform” provides such a basis for reflection. The article reports on the recent merger of freight industry IT service providers Compu-Clearing and Core Freight and their plans to establish a robust and agile IT solution for trade on the African sub-continent.![[Picture: tropic maritime photos, Australia]](https://mpoverello.com/wp-content/uploads/2015/09/c2a9-tropic-maritime-photos-australia.jpg?w=300&h=210)

In collaboration with the European Anti-Fraud Office (OLAF), the JRC has worked extensively on how to exploit CSM data for customs anti-fraud purposes. The JRC proposed techniques, developed the necessary technology, and ran long-term experiments involving hundreds of EU customs officers to validate the usefulness of using CSM data. The results of this research led the Commission to bring forward a legislative proposal that would enable Member States and OLAF to systematically use CSM data for these anti-fraud purposes. It also served to convince Member States of the value of the proposed provisions.

In collaboration with the European Anti-Fraud Office (OLAF), the JRC has worked extensively on how to exploit CSM data for customs anti-fraud purposes. The JRC proposed techniques, developed the necessary technology, and ran long-term experiments involving hundreds of EU customs officers to validate the usefulness of using CSM data. The results of this research led the Commission to bring forward a legislative proposal that would enable Member States and OLAF to systematically use CSM data for these anti-fraud purposes. It also served to convince Member States of the value of the proposed provisions. The technologies, know-how and experience in handling CSM data, developed by the JRC through its experimental

The technologies, know-how and experience in handling CSM data, developed by the JRC through its experimental

![At the launch of Transnet National Ports Authority's new Integrated Port Management System (IPMS) [Transnet]](https://mpoverello.com/wp-content/uploads/2015/08/at-the-launch-of-transnet-national-ports-authoritys-new-integrated-port-management-system-ipms.png?w=300&h=199)

You must be logged in to post a comment.