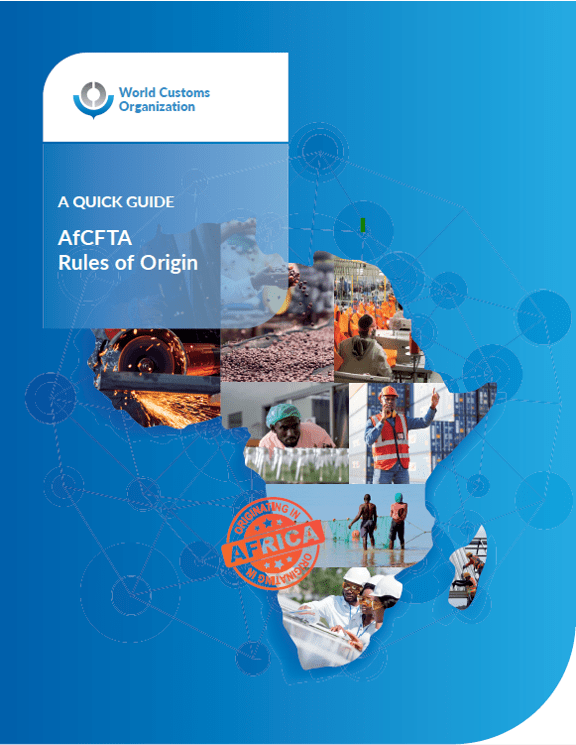

The World Customs Organization (WCO) sets the standards to facilitate and secure international trade. As part of its ongoing commitment to the protection of society, the SAFE Framework of Standards to Secure and Facilitate Global Trade (SAFE FoS) has been updated to ensure that the pathway for a resilient global trading environment is secure and reflects current realities. With a focus on inter-agency cooperation, the WCO’s 186 Members can now implement the new SAFE FoS in areas that highlight collaboration between Customs and environmental authorities, as well as now recognizing the important role that Micro-, Small, and Medium-sized Enterprises (MSMEs) play by ensuring the Authorized Economic Operator (AEO) programme is accessible to them.

WCO Secretary General, Ian Saunders, said: “As we look to the future, the SAFE FoS 2025 is a clear and visible demonstration of the WCO’s enduring commitment to a secure, transparent, and innovative trade environment.”

Advancing secure, efficient, and innovative international trade

The 2025 edition of the SAFE FoS reflects a modernized approach to the full spectrum of supply chain management and focuses on expanding inter-agency cooperation in new areas. Over the past four years, the WCO has worked diligently, in close collaboration with Customs administrations, Private Sector Consultative Group and various stakeholders, to review and identify the areas in this flagship international tool requiring an update to improve cooperation across WCO Members, AEOs and supply chain actors.

The core elements of the SAFE FoS remain unchanged; this new edition expands and enhances the FoS. Building on best practices and lessons learned by the community serves to strengthen collective defenses and drive continual improvement in many aspects of global trade operations.

Through joint efforts, under the leadership and co-facilitation of the New Zealand Customs Service and the Private Sector Consultative Group, four key areas have been added that reflect the realities of today’s supply chain and trade environment.

The key updates in the FoS 2025 are:

- New provisions to enhance collaboration with environmental authorities to increase the focus on global climate change and reflect the desire of Customs to support the global sustainability agenda. By recognizing the linkages between trade, environment, and security, this edition recognizes the importance of environmental authorities. Alignment of procedures and controls for applicable standards between Customs and environmental authorities will support sustainability of trade.

- Recognition that MSME’s should be part of the AEO programme. The WCO and its members determined it was time to expand the reach of AEO programmes to Micro-sized enterprises along with Small and Medium-sized Enterprises (MSMEs). A focus on inclusivity for the eligibility of AEO programmes and the tailoring of standards to the MSMEs’ unique needs will serve to further expand opportunities for secure trade and increase sustainable economic growth of businesses of all sizes.

- A requirement for AEOs to adopt a Code of Conduct (Ethics) will serve to enhance the integrity and accountability of the supply chain for AEOs and Customs. The addition of this requirement, with a focus on ethics, demonstrates that AEOs are committed to the security of their organization which will facilitate future recognition as trusted traders. By improving integrity in the premises of AEOs, the implementation of Codes of Conduct will contribute to the overall security of international trade.

- Addressing insider threats and internal conspirators is a growing concern. The SAFE FoS 2025 expands upon the joint role that Customs and AEOs play in raising awareness and proactively implementing measures to combat this issue given the risk to the supply chain and security in the trade environment. Now both the AEOs and Customs are encouraged to make every effort to educate their personnel with regard to the risks posed by internal conspirators and insider threats to supply chain integrity.

With specific recognition to the participation and contributions of Customs representatives from Australia, the European Union, Guatemala, and the United Kingdom along with the International Chamber of Commerce, the FoS 2025 updates will fortify the collective defences and drive continual improvement in many aspects of global trade operations for Customs administrations, industry stakeholders and business communities around the world.

Implementation

The implementation of each of the three pillars of the SAFE FoS – Customs-to-Customs network arrangements, Customs-to-Business partnerships and Customs-to-other Government Agencies cooperation – is designed to be done as a whole to balance trade facilitation and supply chain security. By implementing the SAFE FoS 2025, all stakeholders can enhance and expand existing cooperation and build trust and transparency in their operations.

Secretary General Ian Saunders calls upon Customs administrations, industry partners, and business of all sizes “to embrace these standards as a foundation for achieving a more secure and prosperous future with the support of international trade.”

Source: WCO

You must be logged in to post a comment.